Wealthsimple Cash Review 2026: Rates & Features

A complete review of the Wealthsimple Cash account in 2026. Learn about current interest rates, the prepaid Mastercard, foreign transaction fees, and CDIC coverage.

The Wealthsimple Cash account (now called “Chequing”) has evolved into one of Canada’s most competitive everyday banking products. I’ve been using Wealthsimple Cash as my primary spending account for over two years now, and it’s completely changed how I think about everyday banking in Canada. This review covers everything you need to know about interest rates, the prepaid card, and whether it can replace your traditional bank.

What Is the Current Wealthsimple Cash Interest Rate?

The current Wealthsimple Cash interest rate ranges from 0.75% to 2.25%, depending on your client tier and direct deposit status. Keep in mind that the Wealthsimple cash account interest rate fluctuates with the market—specifically, it moves with Bank of Canada rate decisions. As of early 2026, here are the current rates:

| Tier | Base Rate | With Direct Deposit* | Maximum Rate |

|---|---|---|---|

| Core (under $100K) | 0.75% | +0.50% | 1.25% |

| Premium ($100K+) | 1.75% | +0.50% | 2.25% |

| Generation ($500K+) | 2.25% | — | 2.25% |

Direct deposit boost requires $2,000+/month deposit from payroll or government payments. The direct deposit boost applies across all chequing accounts (individual and joint). Note: The highest interest rate you can receive is 2.25%—rates do not stack beyond this cap.1

How This Compares to Big Banks

| Institution | High-Interest Savings Rate |

|---|---|

| TD | 0.01% - 0.10% |

| RBC | 0.01% - 0.10% |

| BMO | 0.01% - 0.10% |

| Scotiabank | 0.01% - 0.10% |

| Wealthsimple | 0.75% - 2.25% |

Wealthsimple offers 10-100x higher interest than traditional banks on everyday cash.

Interest Calculation

- Interest is calculated daily on your balance

- Paid out monthly to your account

- No minimum balance required to earn interest

- No promotional rate that expires

Personal note: One of my favorite notifications is the one I get on the first of the month—seeing the interest deposit land like clockwork is a nice change from my old TD account where I earned practically nothing.

How Does the Wealthsimple Cash Card Work?

The physical card you receive with your Cash account is a prepaid Mastercard—not a traditional debit card. In my experience, it works exactly like any other debit or credit card. I use mine for everything from groceries to online shopping.

Key Features

No Foreign Transaction Fees: This is the standout feature. Most Canadian credit and debit cards charge 2.5% on foreign currency purchases (often called a Foreign Transaction Fee).2 Wealthsimple charges 0%.

Worth noting: while Wealthsimple waives the 2.5% foreign transaction fee, you still pay the Mastercard network exchange rate, which includes a small spread over the mid-market rate. This is standard for all “no-FX-fee” cards in Canada — don’t expect the exact rate you see on Google.

I recently used my card on a trip to the US, and not having to worry about that 2.5% surcharge on every meal and souvenir made a noticeable difference in my travel budget.

For a $5,000 vacation:

- Traditional bank: $125 in FX fees

- Wealthsimple: $0

1% Cash Back: Earn 1% rewards on purchases made with the card.

Mobile Wallet Support: Works with Apple Pay, Google Pay, and Samsung Pay.

ATM Fee Reimbursement: Wealthsimple reimburses unlimited ATM fees (up to $5 per transaction) for withdrawals made worldwide. Reimbursement typically appears within about 4 business days after the transaction settles.3

Limitations

Not Interac Debit: The Wealthsimple card is a prepaid Mastercard, not an Interac debit card. This means:

- ❌ Won’t work at merchants that ONLY accept Interac (rare, but some government offices and small businesses)

- ❌ Can’t use Interac e-Transfer from the card (use the app instead)

- ✅ Works everywhere Mastercard is accepted (99% of merchants)

Hotel & Rental Car Holds: Because this is a prepaid card, hotels and rental agencies deduct the full security deposit from your available balance immediately. Unlike a credit card where it’s just a hold on your limit, here the money actually leaves your account until the hold is released — which can take 5–7 days after checkout. Keep this in mind if you’re using the card for travel.

Loading Limits: As a prepaid card, there may be limits on how much you can spend in a single transaction. These are generally high enough for everyday use.

Is the Wealthsimple USD Account Worth the Fee?

Yes, if you regularly trade US stocks or receive USD income, the account is worth the fee to avoid conversion costs. Wealthsimple offers a USD account:

| Feature | Core | Premium/Generation |

|---|---|---|

| USD Account | $10/month | Free |

| USD Interest | Limited | Yes |

| FX Conversion | 1.5% fee | 1.5% fee |

The USD account is particularly useful for:

- Collecting dividends from US stocks in USD

- Avoiding repeated currency conversions

- Traveling to the US frequently

Is My Money Safe in Wealthsimple Cash?

Yes, Wealthsimple protects your deposits with up to $1,000,000 in CDIC coverage by spreading funds across multiple partner banks.

How It Works

Each partner bank provides up to $100,000 in CDIC coverage per account type.

By spreading deposits across multiple partner banks, Wealthsimple provides up to $1,000,000 in CDIC coverage—10x the standard protection at a single bank.4

What’s Protected

| Account Type | Coverage |

|---|---|

| Chequing cash | Up to $1M |

| Crypto | Not covered |

| Investments | CIPF up to $1M (separate) |

This makes the Cash account one of the safest places to park large amounts of cash in Canada.

What Is the Private Credit Fund for Generation Clients?

Generation clients ($500K+) gain exclusive access to private credit investments.5

What Is Private Credit?

Private credit funds lend directly to businesses, bypassing traditional banks. They typically offer:

- Higher yields than traditional fixed income

- Lower correlation to stock markets

- Regular income distributions

Risk Considerations

Private credit is not risk-free:

- Less liquid than stocks or ETFs

- Default risk on underlying loans

- Not suitable for emergency funds

This product is designed for sophisticated investors who understand the risks and want diversification beyond public markets. See our promotions page for current offers that may help you reach Generation status.

How Do I Open a Wealthsimple Cash Account?

You can open a Wealthsimple Cash account in minutes via the mobile app:

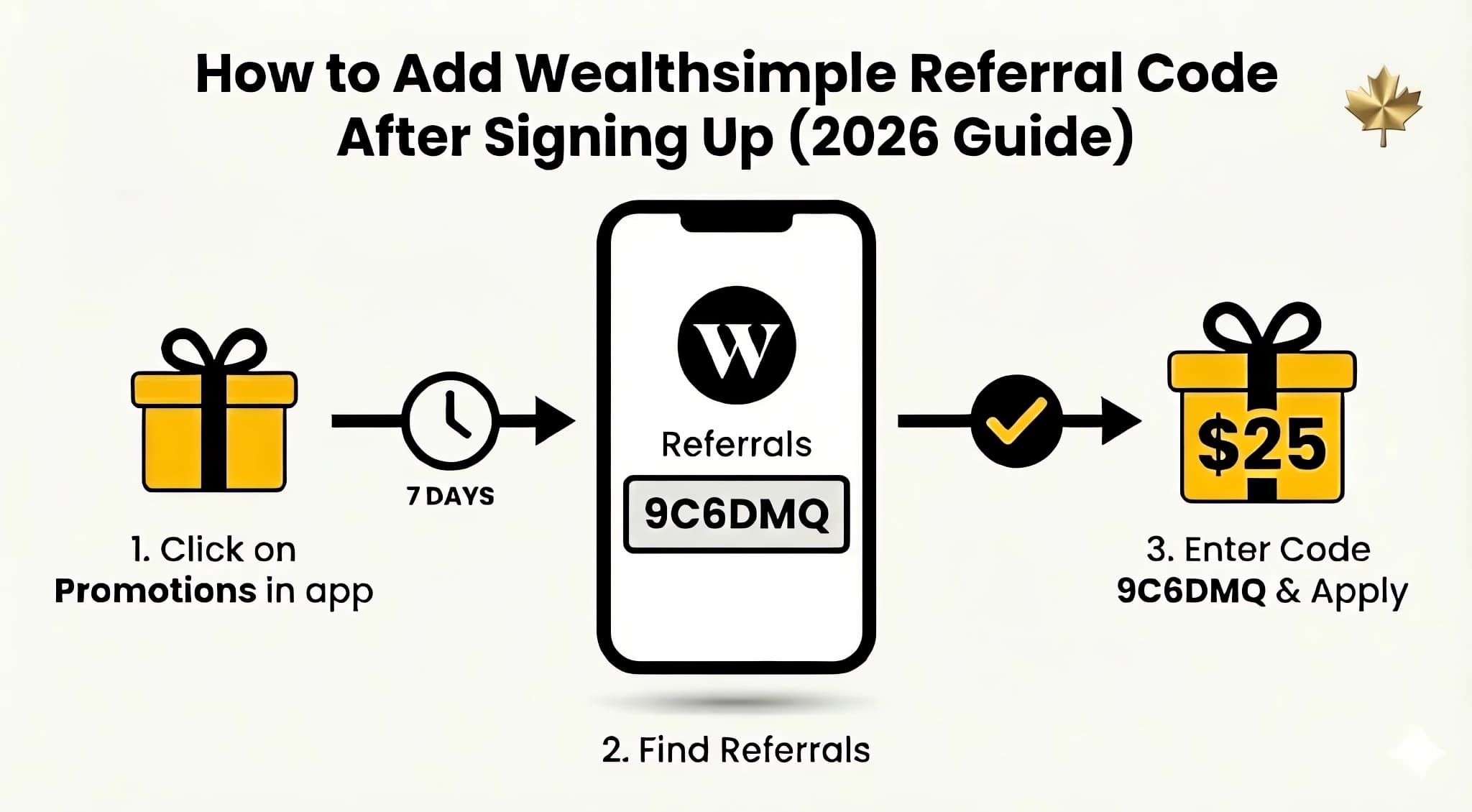

- Sign up with referral code 9C6DMQ — Get a $25 bonus

- Complete identity verification (takes minutes)

- Your Cash/Chequing account is automatically opened

- Order your free prepaid Mastercard

- Link your bank account and transfer funds

There’s no minimum deposit to open the account or start earning interest.

Who Should Use Wealthsimple Cash?

Perfect For:

✅ Emergency funds — High interest + CDIC protection ✅ Travel — No foreign transaction fees ✅ Everyday banking — Modern app, instant transfers ✅ Wealthsimple investors — Seamless integration with trading and RRSP accounts

Maybe Not For:

❌ People who need Interac-only payments — Prepaid Mastercard has limitations ❌ Complex banking needs — No mortgages, lines of credit, etc.

Wealthsimple Cash vs EQ Bank: Which Account Is Better?

The main difference is that Wealthsimple is better for travel (0% FX fees), while EQ Bank offers slightly higher interest rates (up to 2.75%).

| Feature | Wealthsimple Cash | EQ Bank |

|---|---|---|

| Interest Rate | 1.25%-2.25% | 1.00%-2.75% |

| Physical Card | Yes (prepaid) | Yes (Mastercard) |

| FX Fees | 0% | 0% |

| CDIC Coverage | Up to $1M | $100K6 |

| Investment Integration | Full | Limited |

EQ Bank wins on: Slightly higher max rate with direct deposit (2.75% vs 2.25%)

Wealthsimple wins on: Higher CDIC coverage ($1M vs $100K), full investing integration

Both platforms now offer 0% foreign transaction fees on their cards. With recent Bank of Canada rate cuts, interest rates are also similar. The choice comes down to whether you value higher deposit protection and seamless investing (Wealthsimple) or slightly higher savings interest (EQ Bank).

How Do I Get the $25 Sign Up Bonus?

When you open a Wealthsimple Cash account using a referral code and deposit $1+, you receive a $25 cash bonus.

This bonus is deposited directly into your Cash account and is yours to keep (subject to the 180-day hold period).

Sign up with code 9C6DMQ and get your Wealthsimple sign up bonus of $25 today.

Related Articles

- Wealthsimple Guide: Overview, Products & Referral Program

- Wealthsimple Core vs Premium vs Generation

- Wealthsimple vs Questrade 2026

Frequently Asked Questions

What is the Wealthsimple Cash interest rate in 2026?

Rates range from 0.75% to 2.25% depending on client status and direct deposit eligibility. Core clients receive 0.75% base, Premium gets 1.75%, and Generation receives the maximum 2.25%. Eligible Core and Premium clients can increase their rate by 0.5% with qualifying direct deposits ($2,000+/month), and this boost applies across all chequing accounts including joint accounts. Important: The highest interest rate you can receive is 2.25%—this is the absolute cap.

Are there foreign transaction fees?

No, Wealthsimple charges 0% on foreign purchases, making it one of Canada’s best travel cards.

What’s the best Wealthsimple sign up bonus?

The best sign up bonus is the referral code 9C6DMQ—you get $25 cash for just a $1 deposit, plus it goes directly into your Cash account and starts earning interest immediately. See our full guide for details on how the referral program works.

Can I use the Wealthsimple card at Costco?

Yes! Costco Canada accepts Mastercard, so the Wealthsimple prepaid Mastercard works perfectly there. This is a common question since Costco previously only accepted Amex. I use my physical Cash card at the Costco warehouse near me regularly—it’s much more convenient than carrying a separate card just for one store.

Can I open a Joint Wealthsimple Cash account with my partner?

Yes. Wealthsimple now supports Joint Chequing accounts. You can invite a partner to join your account directly through the app. Both owners will have full access to the funds and can each order their own physical Wealthsimple Cash card.

Does Wealthsimple reimburse ATM fees charged by other banks?

Yes. Wealthsimple reimburses an unlimited number of ATM fees up to $5 each for withdrawals made worldwide, with reimbursement typically appearing within about 4 business days after the transaction settles.

How long do mobile cheque deposits take to clear?

It depends on your instant deposit limit. If your limit is $3,000 and you deposit a $1,000 cheque, the funds are usually available immediately. If you deposit a $10,000 cheque, the first $3,000 is available instantly, and the remaining $7,000 will be held for approximately 5–7 business days to clear.

Does the Wealthsimple Cash account have overdraft protection?

No. The Wealthsimple Cash account does not offer traditional overdraft protection or credit. If a transaction (like a pre-authorized payment) pushes your balance below zero, you must add funds immediately to resolve the negative balance, or your account may be suspended.

Will I actually get paid a day early with direct deposit?

In most cases, yes. Traditional banks hold payroll funds until the official “payday” (usually Friday). Wealthsimple releases the funds as soon as they receive the notice from the payment clearing system, which often happens on the afternoon or evening of the previous day (e.g., Thursday).

Sources

Footnotes

About the Author

Isabelle Reuben is a specialized finance writer focused on Canadian investment platforms and bonus optimization. With 5+ years tracking robo-advisors, she stress-tests Wealthsimple's features to transform fine print into actionable blueprints.