Wealthsimple Referral Bonus Terms 2026: Eligibility, Clawbacks & The 180-Day Rule

What are the rules for Wealthsimple's $25 referral bonus? Eligibility, $1 minimum deposit, 180-day hold period, tax implications, and disqualification scenarios.

Before claiming your Wealthsimple sign up bonus, it’s important to understand the terms and conditions. Get the current Wealthsimple referral code if you haven’t already. This guide breaks down the fine print in plain English so you know exactly what to expect from your referral bonus.

Who is eligible for the Wealthsimple referral bonus?

Who Can Receive a Referral Bonus?

To qualify for the Wealthsimple sign up bonus of $25 (or higher tier), you must meet ALL of the following criteria:

| Requirement | Details |

|---|---|

| New Client Status | Never opened a Self-directed, Crypto, Managed Investing, or Chequing account |

| Canadian Residency | Must be a legal resident of Canada |

| Age of Majority | Must be 18+ (19+ in some provinces) |

| Account Standing | Must be able to pass identity verification |

My identity verification took less than 5 minutes—I just had to snap a photo of my ID and a selfie. It was much smoother than the manual verification I had to do with my traditional bank.

What Counts as a “New Client”?

- Completed identity verification for any of the above products

- Started registration and funded any investment product

Personal note: I actually started as a Wealthsimple Tax user before ever opening a Cash account. I was worried I wouldn’t count as a “new client” for the $25 bonus, but the terms are very specific—Tax doesn’t count against you. My bonus landed in my account perfectly within 24 hours of my first $100 deposit.1

If you’ve opened any of those products before, you’re not considered new for the referral program. Wealthsimple’s definition of “new client” is tied specifically to Self-directed, Crypto, Managed Investing, or Chequing accounts. These are the only products that “count” for the new client definition.

Good news for Tax users: Using Wealthsimple Tax alone doesn’t disqualify you. The official “new client” definition is explicitly limited to investment and chequing products—the tax product is not mentioned. If you’ve only ever used Wealthsimple Tax to file your returns, you’re likely still eligible for the $25 bonus when you open and fund your first investment account.

Reactivation offers: Some users who signed up years ago and never engaged may receive special “reactivation” offers with different terms.

What are the funding requirements?

Minimum Deposit: Just $1

The minimum deposit required to trigger the standard referral bonus is $1. Unlike competitors who require $100 or more, Wealthsimple makes it accessible to everyone.

30-Day Funding Window

You must fund your account within 30 days of:

- Entering the referral code, OR

- Opening your account (AND if the code was applied during signup)

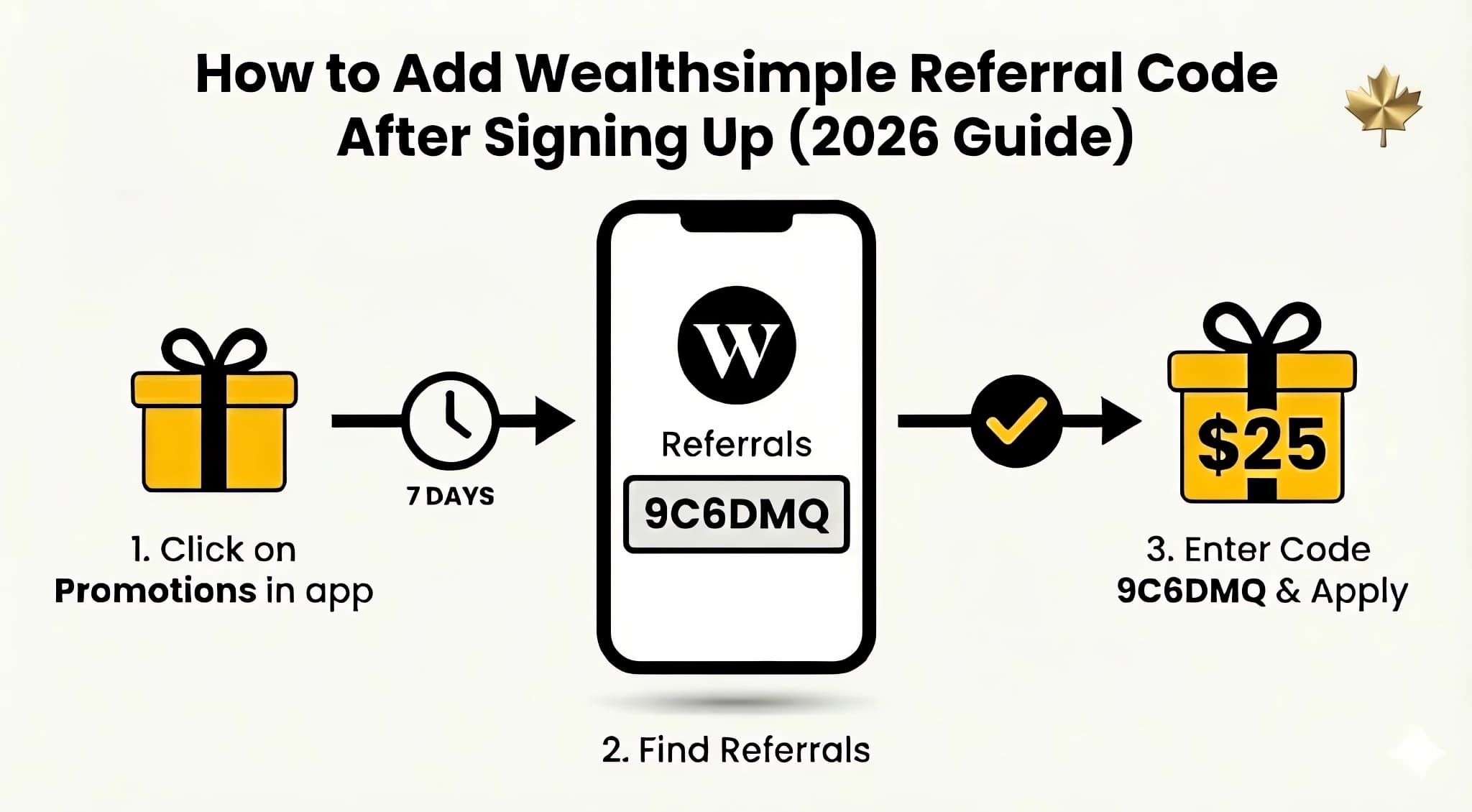

If you miss this window, the referral relationship expires and no bonus is paid to either party. One detail worth noting: transfers that are initiated within the 30-day window but complete later still count — you don’t need the funds to fully settle by day 30, just the request. If you already created your account without a code, see our guide on how to add a referral code after signing up.

Exception: If you’re doing an institutional transfer (RRSP, TFSA, LIRA from another bank), you get a 90-day window instead. This accounts for the fact that bank-to-bank transfers can take 2-4 weeks.2

Where Can the Deposit Go?

Your qualifying deposit can go into any of these account types:

- ✅ Self-directed Trading account

- ✅ Managed Investing (robo-advisor)

- ✅ Crypto account

- ✅ Chequing account

- ✅ TFSA, RRSP, FHSA, or other registered accounts

When and where is the bonus paid?

When You’ll Receive Your Bonus

Most users receive their referral bonus within 24 hours of making a qualifying deposit. In rare cases, it may take up to a few business days.

Where the Bonus Is Deposited

Your bonus is deposited into your Wealthsimple Chequing account, not your investment account. (If your app still says “Cash” instead of “Chequing,” don’t worry — Wealthsimple rebranded the Cash account to Chequing to reflect its daily banking features. They’re the same product.)

Why? This is intentional. If the bonus went into your TFSA or RRSP, it would count as a contribution and use up your contribution room. If you have a joint Chequing account, the bonus deposits to the primary holder’s account (whoever initiated the joint account), not the secondary holder’s view. By depositing it into Chequing:

- No contribution room is affected

- You can access it immediately

- You can move it wherever you want

Important: If you don’t have a Chequing account open, Wealthsimple may give you a grace period (typically 30-90 days) to open one. Otherwise, you might not receive your bonus.

The 180-Day Hold Period

Here’s a critical detail many people miss: you must keep the bonus in your Wealthsimple account for 180 days.

What happens if you withdraw early?

- The bonus amount may be deducted from your withdrawal

- This applies even if you’re withdrawing from a different account than where the bonus was deposited

Example: You receive a $25 bonus in your Chequing account but later withdraw $500 from your TFSA within 180 days. Wealthsimple may deduct $25 from that withdrawal.1

Personal note: I’ve seen some people get caught out by this. They think that since they have $10,000 in the account, withdrawing $100 won’t matter. But the terms are clear: any withdrawal within that first 180 days can trigger a clawback of the bonus. I just treat that bonus as “locked” for the first six months to be safe.

Referral Ladder Bonuses

For deposits larger than $1,000, additional bonus tiers apply:

| Deposit Amount | Total Bonus |

|---|---|

| $1 – $999 | $25 |

| $1,000 – $9,999 | $50 |

| $10,000 – $49,999 | $100 |

| $50,000 – $99,999 | $200 |

| $100,000 – $499,999 | $500 |

| $500,000 – $999,999 | $1,500 |

| $1,000,000+ | $5,000 |

Extended Funding Period for Transfers

If you’re transferring assets from another institution, you get extra time:

- Standard deposits: 30 days

- Institutional transfers: Up to 90 days

This accommodation exists because bank transfers can take 2-4 weeks to complete, and Wealthsimple doesn’t want you penalized for your old bank’s slow processing.

For the full tier breakdown and transfer strategy, see the Referral Ladder Challenge guide. You can also compare promotional offers vs referral bonuses to decide which is more valuable for your situation.

Is the Wealthsimple referral bonus taxable?

No Tax Slips Issued

Wealthsimple does not issue tax slips (like T4A) for referral bonuses. However, this doesn’t mean the income is tax-free.3

Your Reporting Responsibility

Technically, referral bonuses may be considered taxable income. Whether you need to report it depends on:

- Your overall tax situation

- The total amount received

- Whether you’re treating it as casual income or part of a business

Most individual users receiving one-time $25 bonuses don’t report them separately, but consult a tax professional if you’re earning significant amounts through referrals. If you’re already filing with Wealthsimple Tax, it simplifies tracking—see our Wealthsimple Tax review for how the platform handles reporting.

Why Bonuses Go to Chequing, Not TFSA

If your $25 bonus was deposited directly into your TFSA, it would:

- Count as a contribution

- Use up $25 of your contribution room

- Potentially cause over-contribution if you’re near your limit

By depositing to Chequing, Wealthsimple avoids this problem entirely.

What disqualifies you from the referral bonus?

Wealthsimple may reject your referral if:

| Scenario | Result |

|---|---|

| Previously opened any Wealthsimple investment account | Ineligible |

| Failed identity verification | No bonus until resolved |

| Funded after 30-day window | Referral expires |

| Attempted to refer yourself | Both accounts may be suspended1 |

| Used fraudulent information | Account closure |

Self-Referral Is Not Allowed

Attempting to create multiple accounts to refer yourself is against the terms and can result in:

- Forfeiture of all bonuses

- Account suspension

- Permanent ban from the platform

Quebec Residents

Most Wealthsimple promotions and referral bonuses are available to Quebec residents, but some specific promotions may be excluded. Always check the specific terms of any promotion if you’re in Quebec. For a broader overview of what Wealthsimple offers across all provinces, see our complete Wealthsimple guide.

Getting Your Bonus: Quick Checklist

Before signing up, make sure you can check all these boxes:

- I’ve never had a Wealthsimple investment account

- I’m a Canadian resident of legal age

- I will fund my account within 30 days

- I have (or will open) a Wealthsimple Chequing account

- I won’t withdraw the bonus for 180 days

If everything checks out:

Sign up with referral code 9C6DMQ and get your $25 bonus.

Related Articles

- Wealthsimple Guide: Overview, Products & Referral Program

- How to Add a Referral Code After Signing Up

- Referral Ladder Challenge: Earn Up to $5,000

Frequently Asked Questions

What if I withdraw my original deposit but leave the bonus?

If you try to withdraw any funds (even your original deposit) within 180 days, the bonus may be deducted.

Is there a limit to how many people I can refer?

No. Once you’re a Wealthsimple client, you can refer unlimited friends and earn at least $25 for each successful referral.

Is the Wealthsimple sign up bonus worth it?

Yes, the bonus is worth it. For a $1 minimum deposit, you get $25 in free cash—that’s an instant 2,500% return. If you’re transferring larger amounts, the bonus scales up to $5,000, making it one of the best sign up bonuses in Canadian fintech.

Do I get a T5 or T4A slip for my referral bonus?

No. Wealthsimple generally does not issue tax slips (like a T5 or T4A) for referral bonuses paid into non-registered accounts (like your Cash account). However, this does not mean the income is tax-free; you are still responsible for reporting it to the CRA as “other income” if required.

Will I lose my bonus if my portfolio drops below the deposit requirement?

Generally, no. Wealthsimple’s clawback policy applies to withdrawals, not market performance. If you deposit the required funds and the market value drops, you typically keep your bonus. You only risk losing it if you actively withdraw funds that bring your net deposits below the threshold during the hold period.

Who gets the bonus if I open a Spousal RRSP?

In a Spousal RRSP, the primary account holder (the person making the contributions) is considered the client for the referral program. They must be the one to enter the referral code and meet the funding requirements to earn the bonus.

Is there a special Wealthsimple referral code for students?

No. However, the standard referral code (9C6DMQ) is highly recommended for students because it triggers the $25 cash bonus with a minimum deposit of only $1. This low barrier to entry makes it accessible even on a student budget.

I have a TFSA. Can I use a code if I open a new RRSP?

No. The referral program is strictly for new clients who have never had a Wealthsimple investment or chequing account before. If you already hold any Wealthsimple investment account (Self-directed, Crypto, Managed) or Chequing account, opening a secondary account type (like an RRSP) does not make you eligible for a new client referral bonus.

I only use Wealthsimple Tax. Am I still eligible for a referral bonus?

Yes, in most cases. The official referral terms define a “new client” as someone who has not previously opened a Self-directed, Crypto, Managed Investing, or Chequing account. Wealthsimple Tax is notably absent from this definition. If you’ve only ever used Wealthsimple Tax to file your returns, you’re likely still considered a new client and can claim the $25 bonus when you open and fund your first investment account.

Sources

Footnotes

Wealthsimple - Referral Program: https://promotions.wealthsimple.com/hc/en-ca/articles/19646567019035-Wealthsimple-Referral-Bonus-Promotion ↩ ↩2 ↩3

Wealthsimple Help Centre - Transfer an account to Wealthsimple: https://help.wealthsimple.com/hc/en-ca/articles/1500003503661 ↩

Wealthsimple - Referral Bonus Tax Information: https://promotions.wealthsimple.com/hc/en-ca/articles/19646567019035-Wealthsimple-Referral-Bonus-Promotion ↩

About the Author

Isabelle Reuben is a specialized finance writer focused on Canadian investment platforms and bonus optimization. With 5+ years tracking robo-advisors, she stress-tests Wealthsimple's features to transform fine print into actionable blueprints.