Wealthsimple Tax Review 2026: Is It Actually Free (And Better Than TurboTax?)

A complete review of Wealthsimple Tax for 2026. Learn about features, limitations, and how it integrates with your investments for seamless tax filing.

The Bottom Line: Wealthsimple Tax is currently the best value tax software in Canada because it offers full functionality—including crypto and stock trading—completely for free. Unlike competitors that lock investment forms behind a paywall, Wealthsimple Tax uses a “pay-what-you-want” model (even $0) and integrates seamlessly with Wealthsimple Trade accounts.

Tax season is stressful. But it doesn’t have to be expensive. Wealthsimple Tax (formerly SimpleTax) is a free, CRA-certified tax preparation software that handles everything from simple T4s to complex investment income. If you’re new to the platform, our Wealthsimple guide covers the full ecosystem.

I’ve used Wealthsimple Tax for the last three years, and it’s the only time of year I actually look forward to checking my finances. Moving from a paid software that charged me per slip to a pay-what-you-want model was a breath of fresh air—and yes, I do actually donate because the time saved is worth it. Here’s our complete 2025 review.

Quick Verdict: Which Plan Do You Actually Need?

Most Canadians only need the Basic ($0) plan, while the Plus plan adds audit protection.

| Plan | Price | Best For… |

|---|---|---|

| Basic | $0 (Optional Donation) | 95% of Canadians (Includes Stocks, Crypto & Self-Employed) |

| Plus | $40 | Anxious filers who want Audit Protection |

| Pro | $80 | People who want a 1:1 call with a Tax Expert |

When can I start filing my 2025 taxes with Wealthsimple?

You can begin entering data in early January 2026, but NETFILE transmission opens February 23, 2026. Here’s the complete timeline:

| Event | Date | Notes |

|---|---|---|

| Data Entry Opens | Early January 2026 | Preparation only |

| NETFILE Opens | February 23, 2026 | Filing begins |

| T4/T5 Slips Due | March 2, 2026 | Wait for these! |

| RRSP Contribution Deadline | March 2, 2026 | Last day for 2025 deduction |

| T3 Slips (ETFs/Trusts) Due | March 31, 2026 | ETF investors: wait! |

| Filing Deadline | April 30, 2026 | Avoid penalties |

| Self-Employed Deadline | June 15, 2026 | Interest still starts Apr 30 |

For the latest official deadlines, see the CRA’s Important Dates for Individuals.

If you hold ETFs or REITs in a non-registered account, do not file in February. T3 slips are often not issued until late March. Filing early usually means filing an amendment later.

Is Wealthsimple Tax actually free to use?

Yes, Wealthsimple Tax is 100% free for all users, utilizing a “pay-what-you-want” donation model.

Wealthsimple Tax is a web-based tax preparation and filing service that:

- Is completely free (pay-what-you-want donation model)

- Is CRA NETFILE certified for electronic filing1

- Handles both simple and complex returns

- Integrates directly with Wealthsimple investment accounts

The “Pay What You Want” Model

Unlike TurboTax or H&R Block, Wealthsimple Tax has no mandatory fees. After completing your return, you’re invited to donate what you think the service is worth—including $0.

| Plan | Cost | Returns | Features |

|---|---|---|---|

| Basic | $0 (optional donation) | 2 | Full tax filing capabilities |

| Plus | $40 + tax | 8 | Priority support, audit defense |

| Pro | $80 + tax | 20 | Expert review, 1-on-1 advice |

Wealthsimple Client Perk: If you have $100K+ in Wealthsimple assets (Premium status), you get the Plus plan free. $500K+ (Generation status) gets Pro free. See our Core vs Premium vs Generation breakdown for details on each tier, or check Wealthsimple’s full pricing.

Most users never need more than the free Basic tier. Seriously. The Basic tier is identical in features to the paid plans for the vast majority of Canadians.

Which features are included in the free Basic plan?

The free plan includes CRA Auto-fill capabilities, investment integration, and handling for complex tax situations like self-employment.

Auto-Fill from CRA

Wealthsimple Tax can automatically import your tax slips directly from the CRA. This includes:

- T4 (Employment income)

- T5 (Investment income)

- T3 (Trust income)

- RRSP contribution receipts

- And more

Simply connect your CRA My Account, and most of your slips are imported instantly.

Tip: This is different from the CRA's "SimpleFile" service. SimpleFile is a CRA-run program for low-income filers who receive an invitation. Wealthsimple Tax uses Auto-fill my Return—a feature available to anyone with a CRA My Account.

Personal note: The first time I used the CRA Auto-fill, I was braced for it to fail. Instead, it pulled in all 12 of my T4s and T5s in about 30 seconds. I spent more time double-checking for errors than I did actually entering data.

Watch out for small amounts: If your Wealthsimple Cash account earned less than $50 in interest, the T5 slip often won’t appear in the CRA Auto-fill data. You’ll need to manually check your monthly statements and enter this amount — the CRA doesn’t require banks to issue slips for small amounts, but you’re still legally required to report it.

Auto-fill first, then edit: Be careful not to enter T4 slips manually before using Auto-fill — this often creates duplicate entries that are difficult to remove. Always Auto-fill first, then review and edit.

Investment Integration

Here’s where Wealthsimple Tax shines for investors:

Direct Wealthsimple Import: If you have Wealthsimple trading accounts, your trading activity is automatically imported, including:

- Capital gains and losses

- Foreign income (dividends from US stocks)

- Cryptocurrency transactions

- Adjusted Cost Base (ACB) calculations

Heads up for Managed Investing users: Expect “Slip Shock” — the system imports individual T5008 slips for every rebalancing transaction, sometimes 100+ entries. Look for the Summary entry at the top of the list and use that instead of trying to verify each line individually.

Don’t panic over phantom distributions: If you see Box 21 (Capital Gains) on your ETF T3 slips even though you didn’t sell a single share, these are “phantom distributions” — reinvested gains from inside the fund. Beginners often delete these thinking they’re errors, but doing so will trigger a CRA discrepancy.

The Crypto Advantage: Wealthsimple Tax stands out by directly integrating with Wealthsimple Trade accounts to auto-calculate Adjusted Cost Base (ACB) and Capital Gains/Losses. Calculating crypto taxes manually is notoriously complex. Wealthsimple Tax auto-imports your crypto transactions and calculates ACB automatically—a feature that could save you hours.

I trade both stocks and crypto, and the automatic ACB (Adjusted Cost Base) calculation is a lifesaver. Before this, I was maintaining a massive, complex spreadsheet that I never quite trusted. Seeing the Gains/Losses sync perfectly from my Wealthsimple Trade account was the moment I was sold. If you’re comparing crypto platforms, see our Wealthsimple Crypto vs Newton vs Shakepay breakdown.

Important caveat for transfers: If you transfer crypto into Wealthsimple from a cold wallet or another exchange, the tax software may default the Acquisition Cost to the market price at the time of transfer — effectively resetting your ACB. You must manually audit these entries against your own records, or you could overpay significantly on capital gains.

Comprehensive Tax Situations

Wealthsimple Tax handles:

Refund Optimization

The software includes tools to maximize your refund:

Pension Income Splitting: Automatically suggests the optimal split between spouses.

Spousal Dividend Claims: Identifies when transferring dividends benefits your family tax position.

Carryforward Amounts: Tracks unused tuition credits, capital losses, and donation amounts from previous years.

RRSP Optimizer: Shows exactly how RRSP contributions will impact your refund.

A note on “Combined Refunds” for couples: The dashboard shows a total Combined Refund, but the CRA never issues joint payments. You’ll each receive your own separate deposit (or bill). Don’t plan your spending around the combined number until you see whose account it actually lands in.

100% Accuracy Guarantee

Wealthsimple Tax guarantees that if you owe penalties or interest due to a calculation error they made, they’ll pay the difference.2

What’s new in Wealthsimple Tax for 2026?

Key updates for 2026 include video walkthroughs, guided filing, and direct CRA payments.

Tax Video Walkthroughs

New video guides walk you through different sections of your tax return.

Guided Tax-Filing

A new assistant helps build a template based on your specific situation.

CRA Payments Integration

If you owe taxes, you can now add the CRA as a payee directly in your Wealthsimple Chequing account.

What are the downsides of using Wealthsimple Tax?

The main downsides are the lack of phone support for free users and the inability to file T3 Trust returns.

No Desktop App to Download

Searching for a “Wealthsimple Tax desktop download”? There isn’t one. Wealthsimple Tax is a web-based application—you access it through your browser at wealthsimple.com/tax.

| Requirement | Status |

|---|---|

| Operating Systems | Windows, Mac, Linux |

| Browsers | Chrome, Safari, Firefox, Edge |

| Internet Explorer | Not supported |

| Mobile App | None (web-only) |

“Desktop” in Wealthsimple’s context simply means the web experience on a computer, which offers better screen real estate for complex forms than mobile.3

Support Limitations

Free users only have email support. Live chat and phone support are reserved for Plus and Pro subscribers.

Return Limits by Plan

The number of returns you can file depends on your plan:

- Basic (free): 2 returns

- Plus ($40): 8 returns

- Pro ($80): 20 returns

This may be a consideration if you’re doing taxes for many family members.

Quebec Complex Returns

While Quebec returns are supported, some very complex Quebec-specific situations may not be fully covered.

No T3 Trust Returns

If you’re an executor handling an estate, note that Wealthsimple Tax supports the final T1 return for a deceased individual, but does not support T3 Trust Income Tax returns for the estate itself.2 You’ll need separate software or an accountant for that.

Is Wealthsimple Tax better than TurboTax for 2026?

Wealthsimple Tax wins on price and investment integration, while TurboTax offers a better mobile app and more live support options.

| Feature | Wealthsimple Tax | TurboTax |

|---|---|---|

| Base Price | Free | $0-$200+ |

| Investment Integration | Automatic (Wealthsimple) | Manual import |

| Crypto Calculation | Automatic ACB | Limited |

| Support | Email (free tier) | Chat/phone (paid) |

| Mobile App | Via main Wealthsimple app | Dedicated app |

| CRA Auto-fill | Yes | Yes |

Wealthsimple Tax wins on: Price. Crypto handling. Investment integration.

TurboTax wins on: Dedicated tax app, live support access

For Wealthsimple investors, Wealthsimple Tax is the obvious choice due to seamless integration.

One UX difference worth noting: Unlike TurboTax’s “interview” mode which actively asks “Did you pay foreign taxes?”, Wealthsimple Tax relies on you knowing what to search for. If you don’t type “Foreign Tax Credit” into the search bar, the software won’t always prompt you to add it. You need to know your own tax situation better here.

How does Wealthsimple Tax handle options trading?

Wealthsimple Tax automatically imports your options trading activity and categorizes gains/losses appropriately.

What’s Tracked:

- Premium received from writing options

- Gains/losses from buying and selling options

- Assignment and exercise transactions

Reddit Feedback: Users on r/PersonalFinanceCanada and r/CanadianInvestor report that Wealthsimple Tax handles options better than most retail tax software, though complex multi-leg strategies may require manual review.

Can you invest your tax refund and earn a bonus?

Yes, you can earn a $25 bonus by depositing your tax refund into a Wealthsimple account.

The Funnel:

- Use Wealthsimple Tax (free)

- Receive your tax refund

- Invest the refund in Wealthsimple Trade

- Claim a $25 referral bonus on top

If you’re getting a refund anyway, depositing it into a TFSA with Wealthsimple and earning a bonus is one of the smartest moves you can make.

Sign up for Wealthsimple with code 9C6DMQ and get a $25 sign up bonus when you deposit your refund.

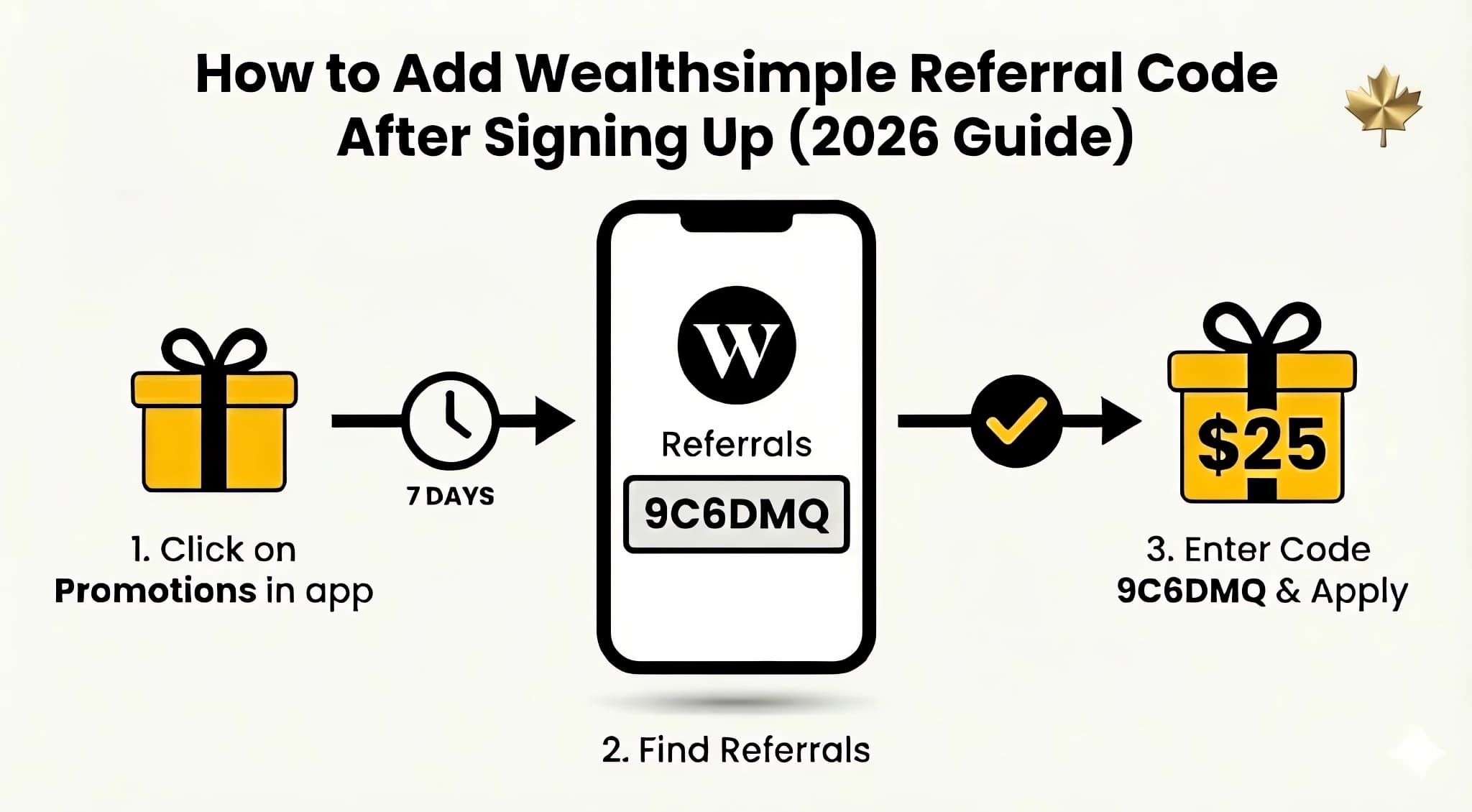

Already have an account but forgot to add a code? You may still be able to claim the bonus within 30 days of signup. See our full guide: How to Add a Referral Code After Signing Up. Not sure about the difference between promo codes and referral codes? We explain it here.

How do you file your taxes with Wealthsimple Tax?

Step 1: Create an Account

Go to wealthsimple.com/tax and sign up (or log in with your existing Wealthsimple account).

Step 2: Import Your Data

Connect to CRA My Account to auto-import slips. If you have Wealthsimple investments, these import automatically.

Step 3: Complete Your Return

The guided interface walks you through each section. Use the search bar to find specific slips or deductions.

Step 4: Review and File

Review your calculated refund/balance. File electronically through NETFILE. If you found the service valuable, you’re invited to donate—but there’s no obligation.

I usually choose to donate about $20 because I find the crypto tax reporting and automatic integrations so valuable that it feels worth it. However, you can absolutely file for free without any guilt—there’s zero obligation to pay, and you get the exact same features either way. It’s significantly better than the “Basic” packages from competitors who often tack on fees for things like RRSP slips.

Is Wealthsimple Tax Right for You?

Wealthsimple Tax is best for DIY investors and students, but those needing hand-holding should look elsewhere.

Who Should Use Wealthsimple Tax

Investors: If you use Wealthsimple Invest or Trade, your T-slips import automatically.

Crypto Traders: It calculates your Average Cost Basis (ACB) for you, which is usually a headache.

Self-Employed: It handles standard business income (T2125) forms for free.

Students: Easily claims tuition credits and carry-forwards.

Who Should Look Elsewhere

Support Seekers: If you prefer calling someone for help, note that phone support is a paid feature.

Complex Scenarios: If you have a complex estate or corporate tax return, a CPA is still safer.

Final verdict: Is Wealthsimple Tax worth it?

So here’s the deal. Wealthsimple Tax is arguably the best free tax software in Canada.

For Wealthsimple investors in particular, the automatic import of trading activity, crypto calculations, and ACB tracking makes tax season significantly less painful.

And when you receive that refund? Consider investing it and claiming a $25 referral bonus.

Sign up with referral code 9C6DMQ and claim your Wealthsimple sign up bonus when you put your refund to work.

Related Articles

- Wealthsimple Guide: Overview, Products & Referral Program

- Wealthsimple Cash Account Review 2025

- Wealthsimple Core vs Premium vs Generation

Frequently Asked Questions

Is Wealthsimple Tax really free?

Yes. You can complete and file your entire return for $0. The donation at the end is completely optional.

Can I file in Quebec?

Yes, Wealthsimple Tax supports both federal and Quebec provincial returns.

Does it handle cryptocurrency?

Yes, and it’s one of the best free options for crypto. If you trade crypto on Wealthsimple, your ACB and gains/losses are calculated automatically.

Does Wealthsimple Tax handle the T1135 form for foreign assets?

Yes. If you hold foreign property with a total cost of over $100,000 CAD, Wealthsimple Tax fully supports Form T1135. It will guide you through using either the Simplified Reporting Method (Part A) or the Detailed Reporting Method (Part B) depending on your asset value.4 Note that while Wealthsimple provides a Foreign Asset Report PDF in your documents, it does not auto-populate the T1135 form — you’ll need to manually transcribe the Maximum Cost Amount and Income figures from that PDF into the tax form fields.

Can I file a final return for a deceased person?

Yes, Wealthsimple Tax supports the preparation and filing of a Final Return (T1) for a deceased individual. However, note that it does not currently support T3 Trust Income Tax returns, which may be required for the estate itself.

Is the “Plus” plan with Audit Protection worth it?

The free version already includes a 100% accuracy guarantee on calculations. The “Audit Protection” in the Plus plan pays for a tax expert to defend you and correspond with the CRA if your return is reviewed. For simple T4 returns, it is likely unnecessary. For self-employed individuals or those with rental income, the $40 fee may be worth the peace of mind.

Can I file taxes for previous years (catch-up filing)?

Wealthsimple Tax uses a rolling support window: currently 2023, 2024, and 2025 tax years are available. Earlier years (2020-2022) were deprecated in late 2025. Note: If you previously filed with Wealthsimple, you can still download PDF copies of your past returns via the Documents section. For new returns from 2022 or earlier, use desktop software like StudioTax or paper forms.5

Where do I find my NETFILE Access Code?

Your NETFILE Access Code (NAC) is an 8-character code located on the top right corner of your previous year’s Notice of Assessment from the CRA. Entering this code verifies your identity and allows you to use the “Auto-fill my return” feature to automatically import your T4s, T5s, and RRSP slips.

Sources

Footnotes

About the Author

Isabelle Reuben is a specialized finance writer focused on Canadian investment platforms and bonus optimization. With 5+ years tracking robo-advisors, she stress-tests Wealthsimple's features to transform fine print into actionable blueprints.