Wealthsimple Crypto vs Newton vs Shakepay (2026): Low Fees vs. Free Bitcoin?

For Canadian investors in 2026, the choice is about which platform fits your strategy. Newton has lowest fees, Wealthsimple offers safety and staking, Shakepay gives free Bitcoin.

Here is the 10-second verdict:

- For Lowest Fees: Choose Newton (best for frequent trading).

- For Safety & Staking: Choose Wealthsimple (best for large “buy & hold” portfolios).

- For Free Bitcoin: Choose Shakepay (best for daily recurring buys & free withdrawals).

The Canadian crypto scene has evolved. In 2026, you no longer need sketchy offshore exchanges. The choice is now between these three regulated giants. But because fee structures are hidden in spreads, finding the “cheapest” option depends entirely on how you trade.

Looking for Referral Codes?

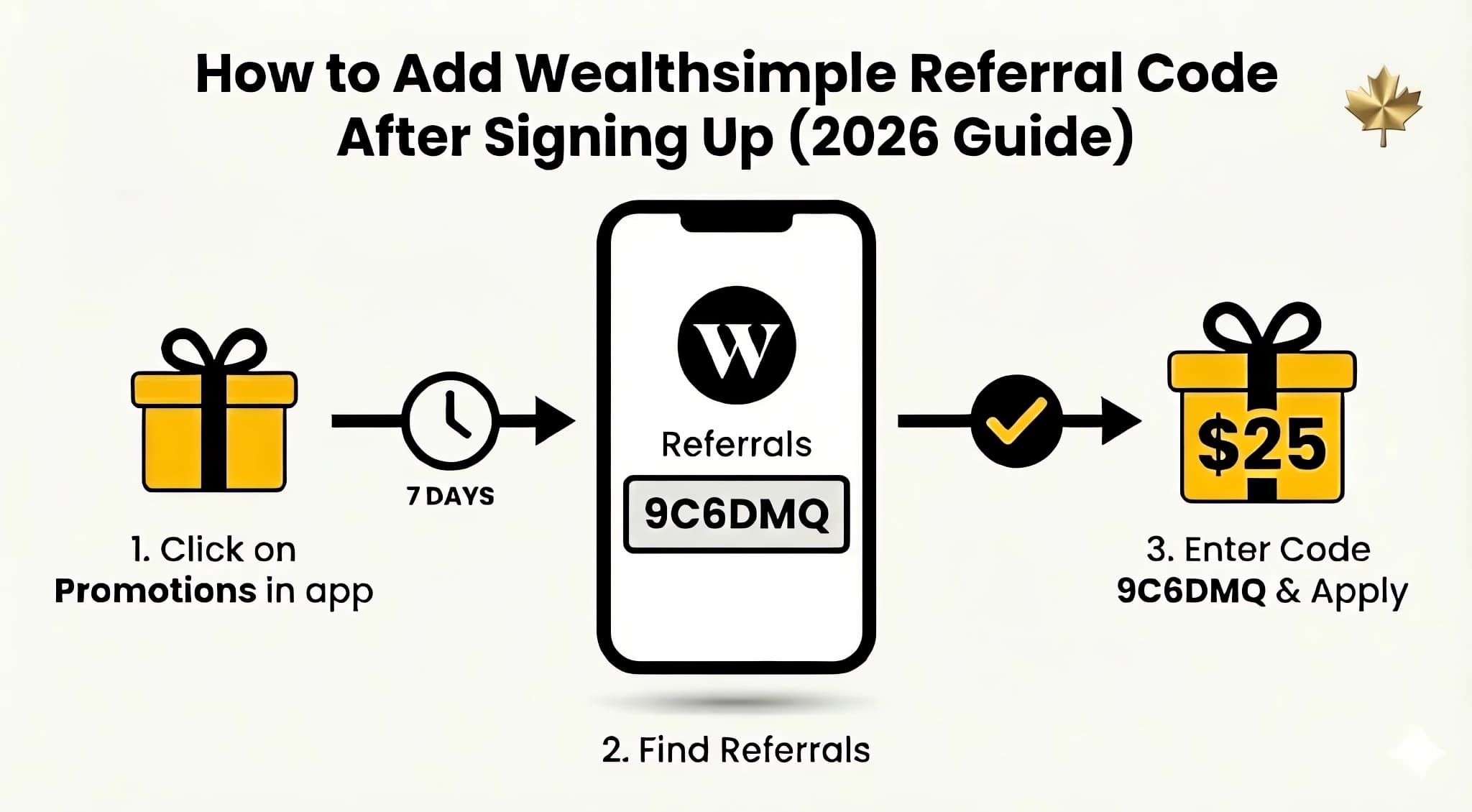

If you just want the sign-up bonuses, here they are:

| Platform | Bonus | Requirement | Code | Link |

|---|---|---|---|---|

| Wealthsimple | $25 | Deposit $1 | Apply ➔ | |

| Newton | $25 | Trade $100 | Apply ➔ | |

| Shakepay | $20 | Trade $100 | Apply ➔ |

Quick Verdict: Which Platform is Best for Beginners?

For beginners, Shakepay is the easiest entry point, while Wealthsimple offers the best integrated ecosystem and Newton wins on fees for altcoin traders.

| Feature | Wealthsimple Crypto | Newton | Shakepay |

|---|---|---|---|

| Best For | All-in-one investors | Altcoin traders | Bitcoin/ETH beginners |

| Coins Supported | 60+ | 70+ | Bitcoin & Ethereum |

| Trading Fees | 0.5% - 2% | 0.5% - 0.7% spread | 1.5% - 2% spread |

| Fiat Deposits | Instant | Instant | Instant |

| Withdrawals | Network fees apply | Free (up to $5 covered) | Free (gas covered) |

| Staking | Yes (ETH, SOL, ADA, DOT) | Yes (ETH, SOL, ADA, DOT) | No |

| Unique Feature | Integrated Ecosystem | Wide Coin Selection | Free Daily Bitcoin (ShakingSats) |

| Regulation | CIRO Regulated1 | OSC Restricted Dealer | CIRO Regulated |

| Verdict | Safest | Cheapest | Easiest |

Which Platform Has the Lowest Fees? (Fee Structure Analysis)

Newton generally offers the lowest trading fees (0.5% - 0.7% spread) for altcoins, while Wealthsimple is transparent but more expensive for small accounts (2% fee).

Here is the reality behind the numbers: Crypto fees are a headache, and companies love to hide them. While Newton claims “no fees,” they make their money on the spread (the gap between the buy and sell price). In my experience trading during high-volatility events, I’ve seen Newton’s spreads widen, but for standard altcoin purchases, they consistently beat Wealthsimple’s 2% Core fee.

Wealthsimple Crypto

Wealthsimple is transparent. They charge an operation fee on every trade. The percentage just depends on how much cash you have with them:

- Core (Under $100k): 2% fee

- Premium ($100k+): 1% fee

- Generation ($500k+): 0.5% fee

Pros: You know exactly what you’re paying. If you’re a Generation client, 0.5% is incredibly cheap for a platform this regulated. Cons: If you’re starting small (Core tier), that 2% fee hurts. A lot.

Newton

Newton claims “no fees”. But that’s marketing speak. They make money on the spread.

- Spread: Usually 0.50% to 0.70% for BTC/ETH, but can be 3-6% for less liquid altcoins

- Surge Pricing: Heads up—when the market goes crazy, these spreads can widen.

Pros: For the average person just trading altcoins, this is often the cheapest option. Cons: The “no fee” tag is misleading. You are paying a fee; you just don’t see it on a separate line.

Shakepay

Shakepay is the easiest app to use. Period. But you pay for that convenience.

- Spread: Typically 1.5% to 2%

Pros: They cover withdrawal gas fees completely — a feature that really matters once you start moving crypto to cold storage. Cons: Don’t day trade here. The fees will eat you alive.

Can You Earn Rewards? (Staking & Rewards)

Yes. Both Wealthsimple and Newton now offer staking (ETH, SOL, ADA, DOT), while Shakepay offers free Bitcoin daily via ShakingSats.

My personal strategy: I actually split my approach here. I use Wealthsimple for my “serious” staking because it’s one-click and the most regulated. But I still open Shakepay every single morning to shake my phone for free Bitcoin via ShakingSats — it’s only a few cents a day, but those sats add up over time.

If you’re holding for the long run, you might as well get paid for it.

Wealthsimple Crypto: The Staking King

Wealthsimple lets you stake Ethereum, Solana, Cardano, and Polkadot.

- Yield: Varies (currently ~3-5% for ETH).

- Convenience: It’s one click. Seriously.

- Cost: They take a cut (30% for Core, 15% for Generation), but frankly, avoiding the technical headache of on-chain staking is worth it for most people.

Shakepay: The “ShakingSats” Phenomenon

Shakepay doesn’t do staking. But they have ShakingSats.

- How it works: Open the app. Shake your phone. Get free Bitcoin.

- The catch: You need a referral code to unlock it.

- Active Shaker requirement: As of 2025, you need to use the Shakepay Card AND make a trade every week to keep “Active Shaker” status. Without it, you only earn 21 sats per shake regardless of streak.

- My take: It sounds silly, but I do it every morning. I’m currently on a 400+ day shaking streak. It’s small amounts, sure. But over a year? It’s basically “free” Bitcoin for a 2-second morning habit.

Newton: Now Offers Staking

Newton launched staking in late 2025, now supporting ETH, SOL, ADA, ATOM, and DOT.

- Yield: Varies by asset.

- Convenience: Easy in-app staking.

- Competition: Now directly competes with Wealthsimple for stakers.

Can You Withdraw to a Private Wallet? (Free vs Paid)

Shakepay is the clear winner here because they cover all withdrawal gas fees, whereas Wealthsimple and Newton charge standard network fees.

Why this matters for your wallet: I use Shakepay as my primary “on-ramp” specifically because of this feature. I’ve saved hundreds of dollars in ETH gas fees just by buying on Shakepay and immediately moving it to my Ledger. If you buy $50 of Bitcoin on Wealthsimple and try to move it, the network fee might eat a chunk of it. On Shakepay, you get the full value.

A note on Newton’s “$5 covered” claim: that $5 works great for cheap chains like Solana or Litecoin where transfer fees are pennies. But for Ethereum or ERC-20 tokens, where gas fees can spike to $15-$30 during congestion, you’ll pay the difference out of pocket.

One caveat on Shakepay’s “free” withdrawals: this only applies to “Normal Speed” transfers (processed within 12 hours), and there’s a minimum of 0.0005 BTC or 0.025 ETH. If you have a smaller balance, you’ll need “Fast Speed” — which charges the network fee. Don’t trap small test amounts expecting to move them for free.

Also worth knowing: if you buy stablecoins like USDC on Wealthsimple to transfer out, there’s a 5-business-day settlement hold before you can withdraw. And be careful with network selection — Wealthsimple strictly supports ERC-20 for most tokens. Sending MATIC via Polygon or USDC via Solana will result in lost funds.

| Platform | Withdrawal Cost |

|---|---|

| Shakepay (Winner) | FREE - They pay the miner fees |

| Newton | Free (up to $5 covered, first daily withdrawal) |

| Wealthsimple | You pay standard network fees |

The Verdict: Which Platform is For You?

The best platform depends on whether you’re a frequent trader (Newton) or a long-term holder (Wealthsimple). I personally keep my “buy and hold” stack on Wealthsimple for the cold storage insurance, but I execute my trades on Newton to save the 1.5% difference.

Choose Wealthsimple Crypto if:

You want it all in one place. If you already check Wealthsimple for your RRSP and stocks, seeing your crypto right next to it is just convenient. It’s also the clear winner for high-net-worth investors who get those low fees, or anyone who wants staking rewards without the stress. Keep in mind that unlike your stocks, crypto is not protected by CDIC insurance.2

| Platform | Bonus | Requirement | Code | Link |

|---|---|---|---|---|

| Wealthsimple | $25 | Deposit $1 | Apply ➔ |

Choose Newton if:

You’re hunting for altcoins. Maybe you want SOL or DOT but don’t have $100k for Wealthsimple Premium. With 70+ coins and tight spreads, Newton is the sweet spot for the average Canadian trader who wants variety without getting gouged.

| Platform | Bonus | Requirement | Code | Link |

|---|---|---|---|---|

| Newton | $25 | Trade $100 | Apply ➔ |

Choose Shakepay if:

You’re a Bitcoin or Ethereum purist. And you love self-custody. The free withdrawals make it the perfect place to buy your BTC and immediately move it to your hardware wallet. Use the referral code, unlock ShakingSats, and get your free daily stats. It’s a no-brainer.

| Platform | Bonus | Requirement | Code | Link |

|---|---|---|---|---|

| Shakepay | $20 | Trade $100 | Apply ➔ |

Frequently Asked Questions

Which platform is safer?

Wealthsimple and Shakepay are both CIRO-registered investment dealers — the gold standard for regulation in Canada.1 Newton is an OSC Restricted Dealer. Wealthsimple uses Gemini for custody with $200M insurance,3 which gives me a lot of peace of mind. As someone who remembers the QuadrigaCX collapse, that CIRO registration provides a level of security I just don’t feel with non-regulated exchanges.

How long does it take to unstake my crypto on Wealthsimple?

For Ethereum, the unbonding period typically takes ~27 hours, but the validator exit queue can add significantly more time. During busy periods, users have reported waiting 20-30 days total. The coin matters too — Solana and Cardano unstake almost instantly, while Polkadot and Ethereum can take weeks. Don’t stake funds you might need quickly.

Why can’t I buy USDT (Tether) on Wealthsimple?

Tether (USDT) is effectively banned on regulated Canadian platforms.4 Wealthsimple is a fully compliant restricted dealer under the OSC, meaning they only list approved stablecoins like USDC.

How do I get my crypto tax documents from Wealthsimple?

Wealthsimple provides a dedicated Crypto Realized Gain Loss Report (CSV) in the app’s documents section. I found it incredibly easy to download this file and upload it directly to Koinly for my taxes — no complex API keys needed. One heads-up though: Wealthsimple does not currently issue a T-slip for staking rewards. You’ll need to manually calculate the CAD fair market value of those rewards yourself for your “Other Income” line.

Is there a limit on how much crypto I can withdraw to my wallet on Wealthsimple?

Yes, the daily withdrawal limit is typically $10,000 CAD (or $25,000 weekly).5 This matters for anyone moving large sums to self-custody. Newton and Shakepay may have different limits, so check this if you plan to move high volumes frequently.

Related Articles

- Wealthsimple Review 2026: Fees, Products & $25 Bonus

- Wealthsimple Core vs Premium vs Generation

- Wealthsimple Cash Account Review

Sources

Footnotes

About the Author

Isabelle Reuben is a specialized finance writer focused on Canadian investment platforms and bonus optimization. With 5+ years tracking robo-advisors, she stress-tests Wealthsimple's features to transform fine print into actionable blueprints.