Questrade vs Wealthsimple (2026): Which Saves You More?

Questrade wins for USD trading with Norbert's Gambit. Wealthsimple is better for simplicity and all-in-one banking. Side-by-side 2026 fee comparison.

For casual Canadian investors who want simplicity and a great mobile app, Wealthsimple is the better choice with free CAD trades and banking in one place. For active traders who need to hold USD currency and avoid conversion fees, Questrade remains superior thanks to Norbert’s Gambit and free USD accounts.

That’s the short answer—but it’s an important one to get right. The real cost differences between these platforms can add up to hundreds or thousands of dollars per year depending on how you invest. Here’s my breakdown after using both platforms extensively.

Already know which platform you want? Grab your sign-up bonus before you start:

At a Glance: Which Platform Wins?

Wealthsimple wins for user experience, while Questrade wins for advanced trading features.

| Feature | Wealthsimple | Questrade |

|---|---|---|

| Canadian Stock Trades | $0 | $0 |

| US Stock Trades | $0 (+ FX fee) | $0 |

| ETF Purchases | $0 | $0 |

| ETF Sells | $0 | $0 |

| Options | $0 | $0 + $0.99/contract |

| Currency Conversion | 1.5% (or USD account) | 1.5% (or Norbert’s Gambit) |

| DRIP | Yes | Yes |

| Robo-Advisor | 0.4%-0.5% | 0.25% (Questwealth) |

| Account Minimum | $0 | $0 |

| Mobile App | ⭐⭐⭐⭐⭐ | ⭐⭐⭐ |

Are Wealthsimple and Questrade Actually Free to Trade?

Yes, both platforms now offer $0 commission trading for Canadian and US stocks and ETFs. As of early 2025, Questrade eliminated commissions to compete with Wealthsimple, leveling the playing field for basic trades.

The History

- Wealthsimple Trade: Launched commission-free from the start

- Questrade: Eliminated commissions in February 2025 to compete1

This levels the playing field for basic stock and ETF purchases. So where do the real differences show up? Currency conversion. Options. And the little details.

Which Platform Is Cheaper for Buying US Stocks?

Questrade is significantly cheaper for frequent US traders due to Norbert’s Gambit, while Wealthsimple charges a mandatory 1.5% fee unless you pay for a subscription or have $100K+ for free USD accounts. However, Wealthsimple has announced Norbert’s Gambit support is coming in Q1 2026, which could level the playing field.

Here’s where the two platforms really differ:

Wealthsimple’s Approach

Standard (Core tier): 1.5% FX fee on every US dollar conversion

- Buy $10,000 of NVIDIA → Pay $150 in FX

- Sell $10,000 of NVIDIA → Pay another $150 in FX

- Round-trip cost: $300 (3%)

With USD Account:

- Core: $10/month subscription

- Premium ($100K+): Free

- Generation ($500K+): Free

The USD Account lets you convert once and hold USD, eliminating per-trade conversion fees.

Questrade’s Approach

Standard: 1.5% FX fee (same as Wealthsimple)2

But with key advantages:

- USD in Registered Accounts: Questrade lets you hold USD in your TFSA, RRSP, etc.—all users, no subscription

- Norbert’s Gambit: Convert CAD to USD for virtually $0 using an interlisted security

What Is Norbert’s Gambit?

Norbert’s Gambit is a technique to convert currency at minimal cost:

- Buy a stock listed on both TSX (CAD) and NYSE (USD) — e.g., Royal Bank (RY)

- Journal the shares from the CAD side to the USD side

- Sell the shares for USD

- Total cost: ~0.05% vs 1.5% with direct conversion

Questrade actively supports this. You can journal shares between currencies for minimal or no fee.

Currency Conversion Verdict

| Your Situation | Better Platform |

|---|---|

| Only trade CAD stocks | Tie |

| Trade occasional US stocks | Wealthsimple + USD Account |

| Trade frequent US stocks (under $100K) | Questrade |

| Trade frequent US stocks ($100K+) | Tie (both free USD) |

| Large USD conversions | Questrade (Norbert’s Gambit) |

Which Platform Is Cheaper for Options Trading?

Wealthsimple is now $0/contract for all users — making it the cheapest options platform in Canada. Questrade charges $0.99/contract. Here’s the full breakdown:

| Wealthsimple | Questrade | |

|---|---|---|

| Commission | $0 | $0 |

| Per-Contract Fee | $0 | $0.99 USD |

As of October 2025, Wealthsimple eliminated all options contract fees. Previously they charged $2/contract (Core) and $0.75 (Premium+), but now every tier trades options for free.

Wealthsimple wins on options pricing across the board.

Both platforms support advanced strategies like spreads and iron condors.

Wealthsimple Invest vs. Questwealth: Which Has Better Value?

Questwealth is cheaper at 0.25% vs Wealthsimple’s 0.4-0.5%, but Wealthsimple offers more features like automatic tax-loss harvesting and Halal portfolios. If you prefer hands-off investing, here’s how they compare:

| Feature | Wealthsimple Invest | Questwealth |

|---|---|---|

| Minimum Investment | $1 | $250 |

| Management Fee | 0.4%-0.5% | 0.25%3 |

| Features | Tax-loss harvesting, Halal | Rebalancing |

Questwealth is cheaper (0.25% vs 0.4-0.5%).

Wealthsimple has more features (automatic tax-loss harvesting, Halal portfolios, SRI options).

For a $50,000 portfolio:

- Wealthsimple: $250/year

- Questwealth: $125/year

The $125 difference—worth it for the extra features? Maybe. It depends on whether you’ll actually use tax-loss harvesting and the SRI/Halal options.

Is Wealthsimple’s App Better Than Questrade’s Desktop Tool?

Yes, Wealthsimple has a significantly better mobile app—but Questrade wins for desktop trading with its IQ Edge platform for power users.

Mobile App

Wealthsimple: Consistently rated among the best financial apps in Canada. Clean, intuitive, fast.

Questrade: Functional but dated. The app works but isn’t as polished. One persistent annoyance: the app logs you out aggressively. Switch to another app for a few seconds and you’re back at the login screen.

Winner: Wealthsimple (significantly better UX)

Personal note: While the Wealthsimple app is objectively more beautiful, I find that Questrade’s “clunkier” interface actually suits my serious investing better. It feels more utilitarian, and their IQ Edge desktop platform is where I do all my heavy lifting and analysis.

Desktop Trading

Wealthsimple: Web-based only. Works well but limited charting and analysis tools.

Questrade: Has IQ Edge, a full desktop trading platform with advanced features for active traders.

Winner: Questrade (for power users)

Research & Tools

Wealthsimple: Basic company info, no advanced charting.

Questrade: More detailed research, better charting options, IQ Edge platform.

Winner: Questrade (for active traders)

Will They Reimburse My Transfer Fees?

Yes, both platforms reimburse transfer fees for accounts over $25,000. Wealthsimple is faster (2 business days vs 5-10) and more automated. Here’s the comparison:

| Wealthsimple | Questrade | |

|---|---|---|

| Minimum Transfer | $25,000 | $25,000 |

| Reimbursement Speed | 2 business days | 5-10 business days |

| Documentation Needed | Automatic | Sometimes required |

Both are comparable, with Wealthsimple being slightly faster. I’ve moved significant assets into both platforms. Wealthsimple’s automation is much smoother—they detected my transfer fee and reimbursed it without me having to upload a single statement. With Questrade, I had to manually submit a PDF of my bank statement, but for the larger portfolio I keep there, the extra five minutes was worth it for the lower long-term FX costs.

Note: Wealthsimple increased their minimum from $15,000 to $25,000 as of April 10, 2025.4 Transfers initiated before that date qualified at the lower threshold.

Can I Use Wealthsimple or Questrade for Banking?

Wealthsimple has a full banking product (Wealthsimple Cash) with interest-earning accounts and a debit card. Questrade has no equivalent banking features.

Wealthsimple Cash

Wealthsimple goes beyond investing with its Chequing account:

- 1.25%-2.25% interest on cash (set up a direct deposit of $2,000/month to unlock an extra 0.5%)

- No foreign transaction fees on card

- CDIC insurance up to $1 million (across partner banks)5

Questrade

No equivalent banking product. Cash in trading accounts doesn’t earn competitive interest.

Winner: Wealthsimple — if you want everything in one app, this is where Wealthsimple pulls ahead.

Which Platform Is Better for Crypto?

Wealthsimple offers direct crypto trading (2% fee) with wallet withdrawals. Questrade only offers crypto through ETFs. Here’s the comparison:

| Wealthsimple | Questrade | |

|---|---|---|

| Direct Crypto | Yes (2% fee) | No |

| Crypto ETFs | Yes | Yes |

| Withdrawal to Wallet | Yes | N/A |

If you want direct crypto exposure in the same app as your stocks, Wealthsimple offers it — see my detailed crypto fee comparison with Newton and Shakepay for a deeper look. Questrade only offers crypto through ETFs.

Who Should Choose Wealthsimple?

✅ Wealthsimple makes sense if you:

- Mostly stick to Canadian stocks and ETFs

- Want a clean, modern app that just works

- Like having investing + banking in one place

- Have $100K+ (Premium tier eliminates those USD fees)

- Want crypto alongside your regular investments

- Prefer simplicity over power features

Who Should Choose Questrade?

✅ Choose Questrade if you:

- Actively trade US stocks

- Want to use Norbert’s Gambit for currency conversion

- Need advanced desktop trading tools

- Prefer the lowest possible robo-advisor fees

- Need access to IQ Edge for options analysis

Ready to Open an Account?

Both platforms offer sign-up bonuses right now. Use the links below to get yours:

What About Interactive Brokers?

Interactive Brokers (IBKR) is the best choice for professional traders who need global market access, but it’s overkill for most Canadians. Here’s the quick comparison:

| Factor | Wealthsimple | Questrade | Interactive Brokers |

|---|---|---|---|

| Target User | Beginners to intermediates | DIY investors | Professionals/Active traders |

| Commission | $0 | $0 | $0.01/share (min $1) |

| USD Conversion | 1.5% or USD Account | Norbert’s Gambit | Best forex rates |

| Global Markets | Canada, US only | Canada, US, some international | 150+ markets worldwide |

| Interface | ⭐⭐⭐⭐⭐ Simple | ⭐⭐⭐ Functional | ⭐⭐ Complex |

| Margin Rates | Higher | Moderate | Lowest in industry |

IBKR wins on: Global market access, margin rates, execution quality, and professional tools.

Wealthsimple wins on: Ease of use, Canadian integration, banking features, and accessibility for new investors.

The verdict: Interactive Brokers is overkill for most Canadians. If you need access to European or Asian markets, complex options strategies, or institutional-level margin rates, IBKR makes sense. For everyone else, Wealthsimple or Questrade covers 95% of needs with a far friendlier experience.

Related Articles

- Wealthsimple Guide: Overview, Products & Referral Program

- Wealthsimple Core vs Premium vs Generation

- Wealthsimple Crypto vs Newton vs Shakepay

- Wealthsimple Cash Account Review

- Referral Ladder Challenge: Earn Up to $5,000

Frequently Asked Questions

Is Wealthsimple or Questrade cheaper?

For CAD investing, they are essentially identical. For USD investing, Questrade is cheaper unless you have $100K+ at Wealthsimple (which gives you free USD accounts).

Which has better customer support?

Wealthsimple has faster, more accessible support via in-app chat. Questrade has phone support but longer wait times.

When is Norbert’s Gambit coming to Wealthsimple?

Wealthsimple has announced that support for Norbert’s Gambit (a method to convert CAD to USD cheaply) is scheduled for release in early 2026. As of February 2026, the feature has not yet launched, and no specific release date has been confirmed. Until then, you must pay the 1.5% FX fee or subscribe to the USD accounts to avoid conversion fees on every trade.

Do I pay ECN fees on Questrade ETF purchases?

Yes. Although Questrade offers $0 commission on ETF buys, you may still be charged ECN fees (roughly $0.0035 per share) if your order “removes liquidity” from the market (e.g., a marketable limit order or market order).6 Wealthsimple does not pass these ECN fees on to the client.

Can I open a Self-Directed RESP on Wealthsimple?

Yes. Wealthsimple recently launched Self-Directed RESPs, allowing you to trade stocks and ETFs inside an education savings plan commission-free. This closes a major gap, as previously only Questrade offered self-directed RESPs.

Does Questrade offer fractional shares like Wealthsimple?

Yes. Questrade now offers commission-free fractional share trading, matching Wealthsimple’s offering. Both platforms let you buy partial shares of expensive stocks like Amazon or Google. Note that Questrade’s fractional shares are currently only available through My Portal, not the IQ Edge desktop platform.

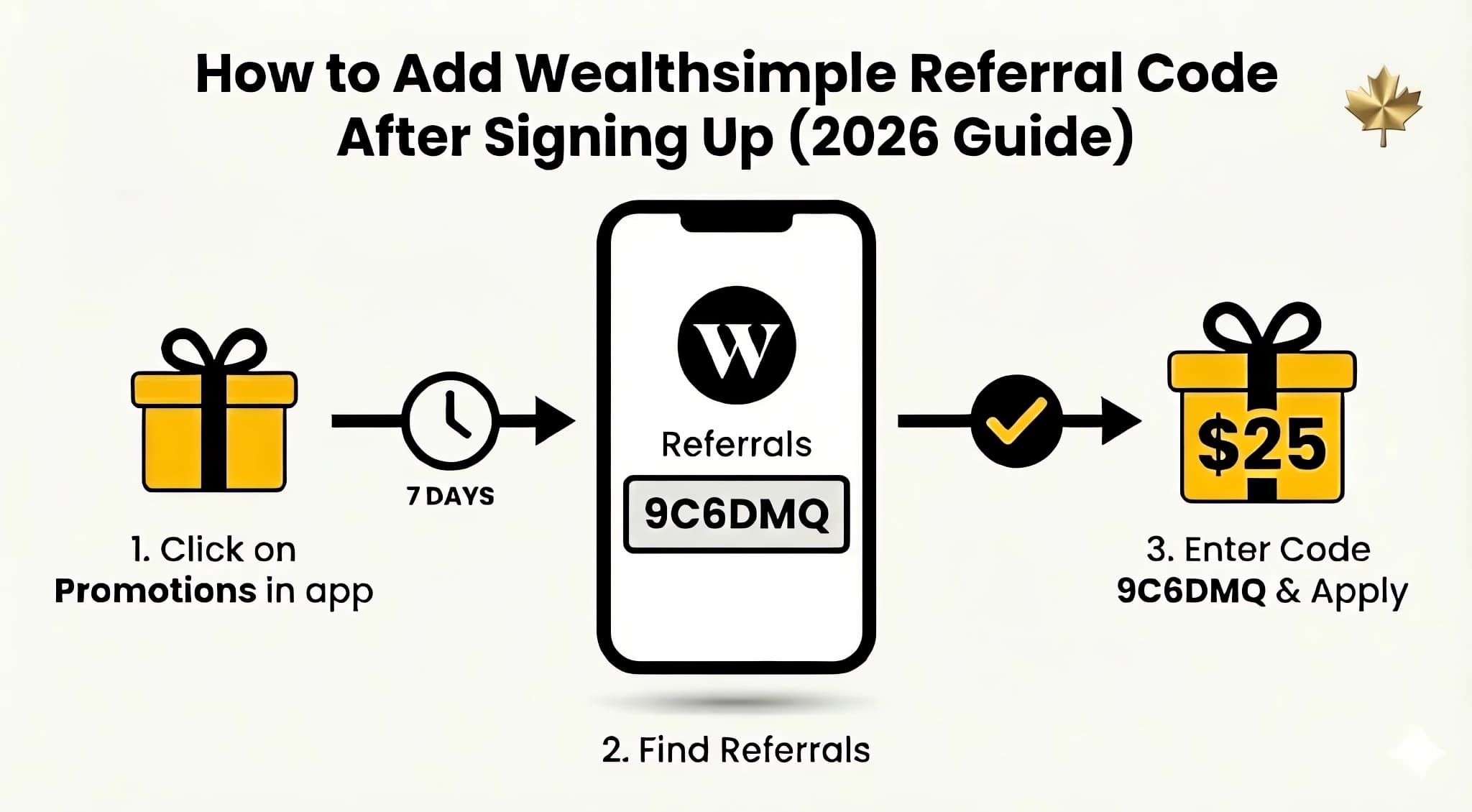

Is the Questrade offer code better than the Wealthsimple referral bonus?

For most beginners, the Wealthsimple referral code is superior because it offers a $25 cash bonus with only a $1 minimum deposit. Questrade’s welcome offers require a minimum deposit of $250 within 60 days of submitting the application.7

Sources

Footnotes

Questrade - Commission-Free Trading: https://www.questrade.com/pricing/self-directed-commissions-plans-fees ↩

Questrade - Foreign Exchange Rates: https://www.questrade.com/pricing/self-directed-commissions-plans-fees/forex-cfd ↩

Questrade - Questwealth Portfolios: https://www.questrade.com/pricing/questwealth-portfolios-fees ↩

Wealthsimple - Pricing: https://www.wealthsimple.com/en-ca/pricing ↩

CDIC - Deposit Insurance Coverage: https://help.wealthsimple.com/hc/en-ca/articles/360056590614-How-we-keep-your-money-safe ↩

Questrade Help - Understanding ECN Fees: https://www.questrade.com/learning/investment-concepts/stocks-201/ecn-fees-explained ↩

Questrade - Referral Program: https://www.questrade.com/about-us/programs-promotions ↩

About the Author

Isabelle Reuben is a specialized finance writer focused on Canadian investment platforms and bonus optimization. With 5+ years tracking robo-advisors, she stress-tests Wealthsimple's features to transform fine print into actionable blueprints.