Wealthsimple Referral Ladder Challenge 2026: Earn Up to $5,000

Learn how the Wealthsimple Referral Ladder Challenge works and how to earn up to $5,000 in cash bonuses when transferring large portfolios.

Most people know about the standard referral code bonus—which is usually $25 but can hit $75 during special promotions—but the Referral Ladder Challenge is where things get serious for referrers. While the new client gets their flat bonus, the person who referred them can earn up to $5,000 for a single transfer. I’ve seen this challenge evolve over the last two years, and it’s completely changed how I think about sharing Wealthsimple with friends who have larger portfolios.

What Is the Referral Ladder Challenge?

The Referral Ladder Challenge is Wealthsimple’s tiered bonus structure that scales your reward based on your net funding amount. The more you deposit, the bigger your bonus.

This program is currently active (subject to change), and targets investors transferring significant assets from traditional banks.

How much can you earn with the Referral Ladder bonus?

Referrers can earn between $25 and $5,000, depending on the new client’s net funding amount. While the person signing up gets a flat cash bonus (typically $25, but up to $75 during promotions), the person who sent the referral earns a tiered reward based on the new client’s net funding amount:1

| Your Net Funding Amount | Base Bonus | Additional Bonus | Total Bonus |

|---|---|---|---|

| $1 – $999 | $25 | $0 | $25 |

| $1,000 – $9,999 | $25 | $25 | $50 |

| $10,000 – $49,999 | $25 | $75 | $100 |

| $50,000 – $99,999 | $25 | $175 | $200 |

| $100,000 – $499,999 | $25 | $475 | $500 |

| $500,000 – $999,999 | $25 | $1,475 | $1,500 |

| $1,000,000+ | $25 | $4,975 | $5,000 |

Net funding is your total deposits minus any withdrawals during the funding period. This prevents gaming the system by depositing and immediately withdrawing.

Example: If you deposit $100,000 and withdraw $10,000 within the funding period, your net funding is $90,000, qualifying you for the $200 tier, not the $500 tier.

Personal note: I once had a friend who accidentally withdrew $500 for an emergency during their funding period, which dropped them into a lower bonus tier. They were devastated! I always tell people: if you’re aiming for a specific tier, keep your hands off the “Withdraw” button until that funding window is completely closed and confirmed.

How does the Wealthsimple Referral Ladder work?

Participating in the ladder involves four simple steps, starting with a valid referral link.

Step 1: Sign Up with a Referral Code

You must use a valid referral code or link when creating your account.

Sign up with referral code 9C6DMQ to get started.

Step 2: Fund Within 30 Days (or 90 Days for Transfers)

Wealthsimple gives you different windows depending on how you fund:

| Funding Method | Time Window |

|---|---|

| Direct bank transfer (EFT) | 30 days |

| Institutional transfer (TFSA, RRSP, etc.) | 30 days |

The official funding window is 30 days for all account types.2 However, institutional transfers (RRSP, TFSA, LIRA) often take 2-4 weeks to process through your old bank. If the transfer is delayed beyond 30 days due to the sending institution, contact Wealthsimple support with documentation showing when you initiated the transfer — they may accommodate the delay.

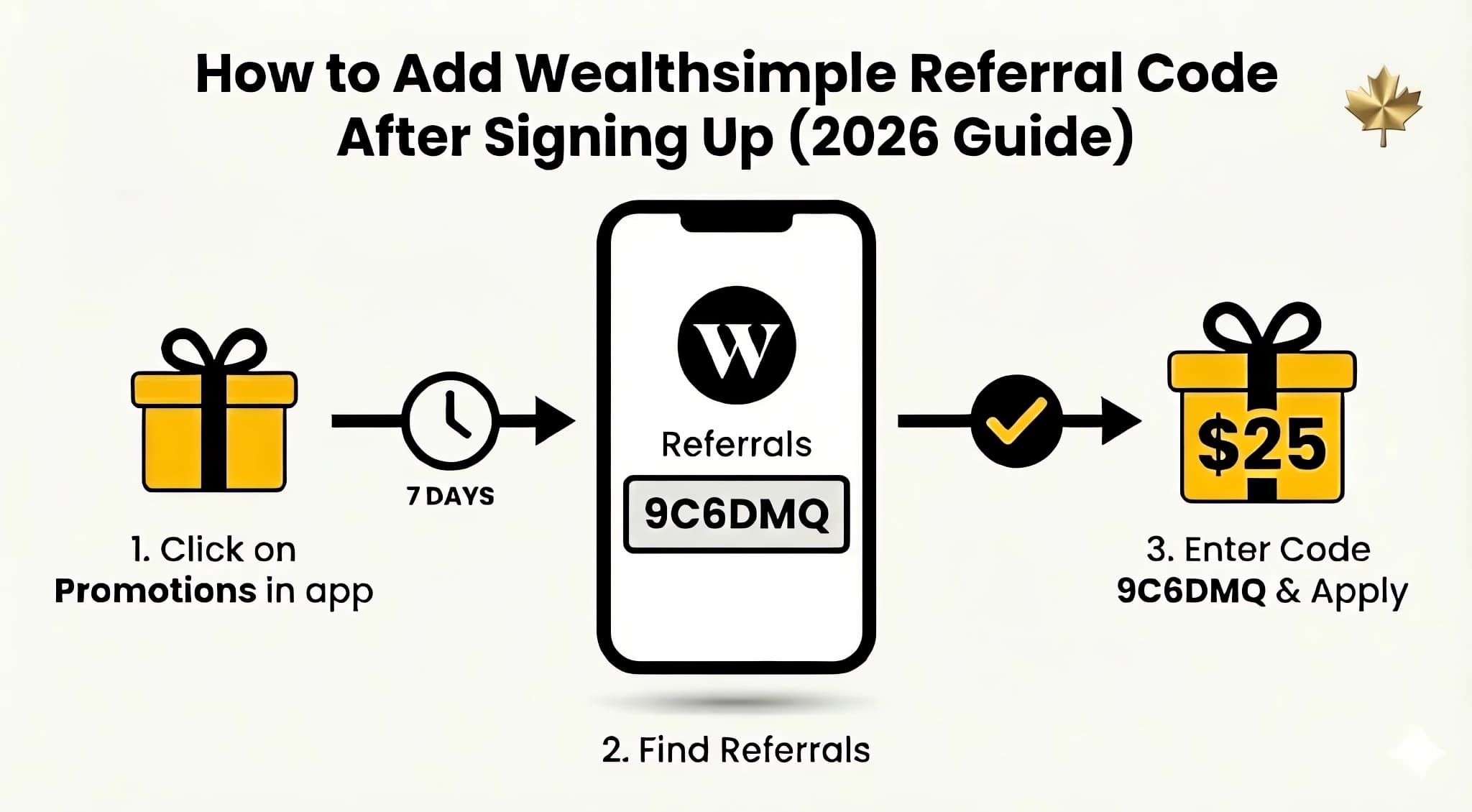

Important: A direct institutional transfer (using form T2033 for registered accounts) moves funds between plans without touching your contribution room. This is different from withdrawing and redepositing, which would consume TFSA/RRSP room. Always let Wealthsimple initiate the transfer—don’t withdraw the money yourself. If you already opened your account without a referral code, you may still be able to add a referral code after signing up.

Transfer tip: Some older institutions (e.g., Sun Life, Investors Group) may reject digital transfer forms and require a wet signature on the T2033. If you’re transferring from one of these providers, print and sign the form manually to avoid a 2-week rejection cycle.

Step 3: Reach Your Target Tier

You have the full funding period to accumulate deposits. Multiple deposits count toward your total.

Example: You deposit $50,000 immediately, then transfer your RRSP worth $60,000 that arrives 3 weeks later. Your total is $110,000, qualifying you for the $500 bonus.

Step 4: Receive Your Bonus

Bonuses are typically paid within 24 hours of reaching your tier, though you’ll receive the additional ladder bonus after the funding window closes and your net funding is confirmed. The base $25 typically lands within 24 hours, but the larger Ladder bonus often arrives about 14 business days after your funding window closes. Don’t panic if only $25 appears initially.

The Math: Is the Ladder Worth It?

Yes, the Referral Ladder is generally worth it, offering 2-3x higher bonuses than typical bank transfer offers.

Scenario: Transferring $200,000

| Platform | Bonus | Requirements |

|---|---|---|

| Wealthsimple | $500 | Use referral code, transfer within 90 days |

| TD Bank | $200-300 | Often requires new accounts + credit products |

| RBC | $100-200 | Typically requires advisor meeting |

| Big Bank Average | ~$200 | Complex requirements, limited availability |

Winner: Wealthsimple – 2-3x higher bonus for your referrer with simpler requirements. Note that big bank offers are often far more complex and have limited availability.3

Scenario: Transferring $1,000,000

| Platform | Bonus | Notes |

|---|---|---|

| Wealthsimple | $5,000 | Cash bonus, no strings attached |

| Private Banks | Varies | Often negotiate fee waivers instead |

| Robo-advisors | $0-500 | Most don’t have programs this large |

At the $1M+ level, Wealthsimple’s $5,000 sign up bonus is effectively a 0.5% signing bonus—comparable to negotiated fee reductions at private wealth managers.

Looking for device promotions instead? If you’re transferring $100K+, Wealthsimple sometimes offers iPhone or MacBook promotions as an alternative to the cash bonus. Often you can stack the standard $25 referral bonus with separate transfer or device promos, but stacking rules vary—always confirm in the current promo’s terms. Compare device promotions vs cash bonuses.

Will Wealthsimple reimburse my transfer fees?

Yes, Wealthsimple reimburses transfer-out fees charged by your old bank.

Current Policy (As of April 2025)

- Minimum transfer: $25,000 (increased from $15,000 in April 2025)

- Reimbursement: One transfer-out fee per institution (typically $135-$150)

- Timeline: Reimbursement appears within 2 business days

- Hold period: Account must stay funded for 90 days

Heads up: If you have older bookmarks or saw Reddit posts mentioning a $15,000 minimum, that policy changed in April 2025. The new minimum is $25,000.4

Combined Savings Example

Transferring $100,000 from TD Bank:

| Benefit | Amount |

|---|---|

| Referral ladder bonus | $500 |

| Transfer fee reimbursement | $150 |

| Total immediate value | $650 |

Plus, if you’re moving to Premium status ($100K+ in assets), you also unlock (note: the status badge can take 24-48 hours to update after your funds settle):

- Lower management fees (0.4% vs 0.5%)

- Free USD account ($120/year value)

- Higher interest rates (up to 1.75% vs 1.25%)

For a full breakdown, see our Core vs Premium vs Generation comparison.

Who Should Use the Referral Ladder?

The ladder is ideal for investors consolidating assets or those leaving high-fee banks.

✅ RRSP/TFSA Consolidators

If you have retirement accounts scattered across multiple institutions, consolidating everything at Wealthsimple can trigger a significant bonus while simplifying your financial life.

✅ Bank Leavers

Frustrated with your Big Five bank’s high fees and poor service? The combination of referral bonus + transfer fee reimbursement makes switching basically free.

✅ Inheritance Recipients

Received a significant inheritance? Starting fresh at Wealthsimple with a referral code maximizes your initial value.

✅ Downsizers

Selling a home and looking to invest proceeds? $500,000+ in proceeds from a home sale gets you a $1,500 bonus.

Common Questions About the Ladder

Does the Bonus Tier Apply to the Referrer Too?

Yes! The person who referred you also receives the corresponding bonus amount. This is why the ladder is sometimes called a “challenge”—it incentivizes referrers to target high-value individuals.

Can I Split My Deposits to Get Multiple Bonuses?

No. Only one referral bonus relationship exists per client. Your total net funding determines your single tier.

What If My Transfer Takes Longer Than 90 Days?

Delays caused by the sending institution (documented) may be accommodated. Contact Wealthsimple support with evidence of when you initiated the transfer.

Are Referral Bonuses Taxable?

Wealthsimple doesn’t issue tax slips for referral bonuses, but the income may still be reportable. Consult a tax professional, especially for larger amounts. See our full Referral Bonus Terms & Conditions breakdown for more on tax implications.

Ready to Maximize Your Transfer Bonus?

If you’re planning to move a significant portfolio to Wealthsimple, here’s your action plan:

- Sign up with referral code 9C6DMQ

- Verify your identity (takes minutes)

- Initiate your institutional transfer

- Watch your bonus grow as funds arrive

For a detailed breakdown of eligibility rules, holding periods, and tax implications, see the Referral Bonus Terms & Conditions guide.

Related Articles

- Wealthsimple Guide: Overview, Products & Referral Program

- Referral Bonus Terms & Conditions Explained

- Wealthsimple vs Questrade Fees 2025

- Wealthsimple Core vs Premium vs Generation

Frequently Asked Questions

What’s the minimum to get more than $25?

$1,000. Once you deposit $1,000+, you qualify for the $50 tier, representing a 100% increase over the base bonus.

Can I transfer my pension to get the bonus?

If you have a locked-in account (LIRA) or defined contribution pension, you can transfer it and it will count 100% toward your Referral Ladder tier. Group RRSPs from former employers are also eligible. These transfers often take 3-4 weeks to process, so ensure you initiate them well before the deadline. I’ve helped a family member transfer their LIRA to Wealthsimple. It’s a bit more paperwork than a standard TFSA transfer, and it took about 5 weeks for the funds to arrive, but hitting that higher referral tier made the wait worth it.

How long do I need to keep the money at Wealthsimple?

The referral bonus has a 180-day hold. The transfer fee reimbursement requires a 90-day hold. Plan to keep funds invested for at least 6 months.

What’s the best Wealthsimple sign up bonus?

The best sign up bonus depends on your deposit amount. For most people, the referral code giving $25 for just $1 is ideal. For high-net-worth transfers ($100K+), either the tiered cash bonus (up to $5,000) or a device promotion may be more valuable.

Can I refer my spouse to the Referral Ladder if we live at the same address?

Yes. Wealthsimple does not restrict referral bonuses based on household address. If your spouse is a new client (meaning they have never held a Wealthsimple investment or chequing account), you can refer them. If you open a joint Cash account together, note that the bonus is deposited into the primary account holder’s individual profile, not the shared joint balance.

Will I receive a T4A tax slip for the referral bonus?

No. Wealthsimple states in their terms that they do not issue T4A slips for referral bonuses paid into non-registered accounts. However, because the bonus is a cash incentive, it may be reportable to the CRA, and you are responsible for determining your tax obligations.5 Note that if you hold the bonus in a Cash account, any interest earned on it may generate a separate T5 slip — that’s the interest income, not the bonus itself.

Can I earn the Referral Ladder bonus on a Corporate Account?

Yes, Corporate accounts may be eligible. The standard referral terms don’t explicitly mention corporate entities, but corporate investing accounts generally qualify as a “new client” relationship — contact Wealthsimple support to confirm before relying on this.6 Wealthsimple usually deposits the cash bonus into a personal non-registered account (like a Cash account) linked to your profile to simplify the tax reporting for your corporation. Be aware that linking a referral to a corporate profile may require contacting support manually rather than using the standard referral link flow.

What happens if my deposit drops in value due to the market?

You will not lose your bonus. Wealthsimple calculates your tier based on Net Funding (total deposits minus total withdrawals). If you deposit $100,000 and the market value drops to $90,000, your “Net Funding” is still $100,000. You only risk a clawback if you actively withdraw funds that drop your net funding below the tier threshold. Be careful with any manual withdrawals — even pulling out dividends or interest that accumulated in your account could reduce your net funding and affect your tier.

Sources

Footnotes

Wealthsimple - Referral Ladder Challenge: https://promotions.wealthsimple.com/hc/en-ca/articles/19646567019035-Wealthsimple-Referral-Bonus-Promotion ↩

Wealthsimple Help Centre - Transfer an account to Wealthsimple: https://help.wealthsimple.com/hc/en-ca/articles/1500003503661 ↩

Financial Post - Great Wealth Transfer coverage: https://financialpost.com/tag/great-wealth-transfer/ ↩

Wealthsimple Help Centre - Transfer Fee Reimbursement: https://help.wealthsimple.com/hc/en-ca/articles/360056543874 ↩

CRA - Gifts and Awards from Employers (Reference for cash incentives): https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/benefits-allowances/gifts-awards-social-events/gifts-awards-long-service-awards.html ↩

Wealthsimple - Open a Corporate Account: https://promotions.wealthsimple.com/hc/en-ca/articles/19646567019035-Wealthsimple-Referral-Bonus-Promotion ↩

About the Author

Isabelle Reuben is a specialized finance writer focused on Canadian investment platforms and bonus optimization. With 5+ years tracking robo-advisors, she stress-tests Wealthsimple's features to transform fine print into actionable blueprints.