Wealthsimple Core vs Premium vs Generation (2026 Comparison)

Is Wealthsimple Premium worth it at $100K? Full breakdown of Core, Premium, and Generation fees, interest rates, and benefits — with real savings math.

Wealthsimple has three client tiers — Core, Premium, and Generation — and your benefits improve as your account balance grows. As a Core client with two years of experience, I’ve watched my accounts grow toward that $100K threshold, so I’ve paid close attention to what each tier actually offers. If you’re wondering whether it’s worth pushing to hit $100K or $500K, this breakdown will help you figure out the real value.

Wealthsimple Core vs Premium vs Generation at a Glance

| Feature | Core ($0-$99K) | Premium ($100K+) | Generation ($500K+) |

|---|---|---|---|

| Management Fee | 0.50% | 0.40% | 0.20%-0.40% |

| Cash Interest | 0.75%-1.25%* | 1.75% | 2.25% (max) |

| USD Account | $10 + tax/month | Free | Free |

| FX Fee | 1.5% | 1.5% | 1.5% |

| Crypto Fees | 2.0% | 1.0% | 0.5% |

| Crypto Staking Cut | 30% | 30% | 15% |

| Options Trading | $2 USD/contract | $0.75 USD/contract | $0.75 USD/contract |

| Priority Support | No | Yes | Yes |

| Private Assets | No | No | Yes |

| Dedicated Advisor | No | No | Yes |

| Referral Eligible | ✅ Yes | ✅ Yes | ✅ Yes |

Core Tier ($0 - $99,999)

The Core tier is where everyone starts, and it’s solid on its own. I’ve been a Core client since opening my accounts, and while I’m aware of the limitations, it covers the basics well. Here’s what you get when you’re just starting out or building your portfolio:

Core Features and Fees

Stock & ETF Trading:

- $0 commission on all Canadian stocks and ETFs

- $0 commission on US stocks and ETFs (with FX caveat)

Managed Investing:

- 0.50% annual management fee

- Automatic rebalancing and dividend reinvestment

Banking:

- 0.75% base interest on Chequing balance

- Can boost to 1.25% with $2,000+/month direct deposit

Crypto:

- 2% trading fee per transaction

- Access to major cryptocurrencies

The Core Catch: 1.5% USD Conversion Fee

Here’s the catch for Core users — there’s a 1.5% currency conversion fee every time you buy or sell US stocks.1 This is the main limitation I’ve noticed in my own trading, and it’s why I’ve mostly stuck to Canadian ETFs.

Example: Buying $10,000 of Apple stock:

- FX fee: $150 (buy) + $150 (sell) = $300 round-trip cost on a single trade

The workaround? The USD Account for $10/month, which lets you hold USD and avoid per-trade conversion.1

For someone trading US stocks monthly, this makes sense:

- Without USD Account: $300+ per trade in FX fees

- With USD Account: $120/year flat fee

Is Core Good Enough?

Yes, if you:

- Only invest in Canadian stocks and ETFs

- Have less than $100K in total assets

- Don’t actively trade US equities

No, if you:

- Frequently trade US stocks

- Have approaching $100K and want lower fees

- Want higher interest on cash

Premium Tier ($100,000+)

Wealthsimple Premium unlocks USD accounts and reduced fees automatically once you reach $100,000 in net deposits across all your accounts.

Premium Benefits: What You Unlock at $100K

Free USD Account:

- Saves $120/year immediately

- More importantly, eliminates the need to convert on every US trade

Lower Management Fee:

- Drops from 0.50% to 0.40%

- Saves $100/year on a $100,000 portfolio

Higher Cash Interest:

- Base rate: 1.75% (vs 0.75%-1.25% for Core)

- With direct deposit: boosted up to the current maximum of 2.25%

Reduced Crypto Trading Fee:

- Trading fee drops from 2% to 1%

Better Options Pricing:

- Per-contract fee drops from $2 to $0.75 USD

Credit Card Fee Waived:

- Wealthsimple Visa Infinite annual fee waived ($240/year value)2

Free Tax Plus:

- Wealthsimple Tax Plus included (audit protection and priority tax support)

Priority Support:

- Faster email and phone response times

Is Premium Worth It at $100K?

Let’s do the math for a typical $100K portfolio:

| Benefit | Annual Value |

|---|---|

| Management fee savings (0.1% × $100K) | $100 |

| Free USD Account | $120 |

| Higher cash interest (on $5K cash) | ~$25 |

| Credit card fee waived (if you have it) | $240 |

| Total Annual Savings | ~$245–$485 |

Premium is absolutely worth it at $100K. The benefits kick in automatically — you don’t have to do anything once you hit the threshold. For most Canadians investing in US stocks, the free USD account alone saves $120/year.

If you’re close to $100K, consider consolidating accounts to reach Premium faster — it’s exactly what I’m planning as my portfolio grows.

Generation Tier ($500,000+)

Wealthsimple Generation grants access to private credit and equity funds for clients with over $500,000 in assets. It targets high-net-worth individuals who might otherwise use full-service wealth managers.

Generation Benefits: What You Unlock at $500K

Lowest Fees Possible:

- Management fee: 0.40% at $500K, scaling down to 0.20% at $10M+

- That’s $1,000–$2,000 saved annually on a $500K portfolio

Maximum Cash Interest:

- 2.25% rate (the highest available)3

- Note: This is the maximum—Wealthsimple explicitly caps interest at 2.25% and rates cannot be stacked beyond this

Lowest Crypto Fees:

- Trading fee: 0.5%

- Staking reward cut: 15%

Private Asset Access:

- Private credit funds

- Private equity investments

- Summit Portfolio — Wealthsimple’s flagship offering for Generation clients, combining public and private assets in a single managed portfolio

- Previously only available to institutional investors with $1M+ minimums

Free Tax Pro:

- Full Wealthsimple Tax Pro package included, with a 1-on-1 strategy call with a tax expert

Lifestyle Perks:

- Up to 40% off Medcan health plans4

- Partner rewards (Uber One, Strava Premium, etc.)

- Dedicated financial advisor access

- Estate planning services

Credit Card Benefits:

- Wealthsimple Visa Infinite annual fee waived ($240/year value)2

Is Generation Worth Pursuing?

If you’re naturally growing to $500K through investing, the benefits are automatic and significant.

Actively chasing $500K just for Generation status? That depends:

- Don’t move money into worse investments just to hit the threshold

- The math: $500K × 0.1% fee savings = $500/year

- Combined with other perks, Generation clients save $1,000+ annually

Fee Comparison: How Much You Save at Each Tier

For a $100K Portfolio

| Cost Category | Core | Premium | Difference |

|---|---|---|---|

| Management (robo) | $500/yr | $400/yr | -$100 |

| USD Account | $120/yr | $0 | -$120 |

| Cash Interest (on $10K) | $125 | $175 | +$50 |

| Net Difference | — | — | -$170 |

For a $500K Portfolio

| Cost Category | Premium | Generation | Difference |

|---|---|---|---|

| Management (robo) | $2,000/yr | $2,000/yr* | $0 |

| Cash Interest (on $25K) | $437 | $562 | +$125 |

| Crypto fees (on $10K trading) | $100 | $50 | -$50 |

| Net Difference | — | — | +$75 |

*Generation fee scales down with higher balances

Which Tier Is Right for You?

Choose Core If:

- You’re just starting out

- Your total assets are under $50K

- You primarily invest in Canadian assets

- You don’t actively trade

Push for Premium If:

- You have $80K+ and can reach $100K

- You trade US stocks regularly

- You want lower crypto fees

- You value priority support

Target Generation If:

- You naturally have $500K+ to invest

- You want access to private assets

- You value lifestyle perks

- You’re consolidating from multiple advisors

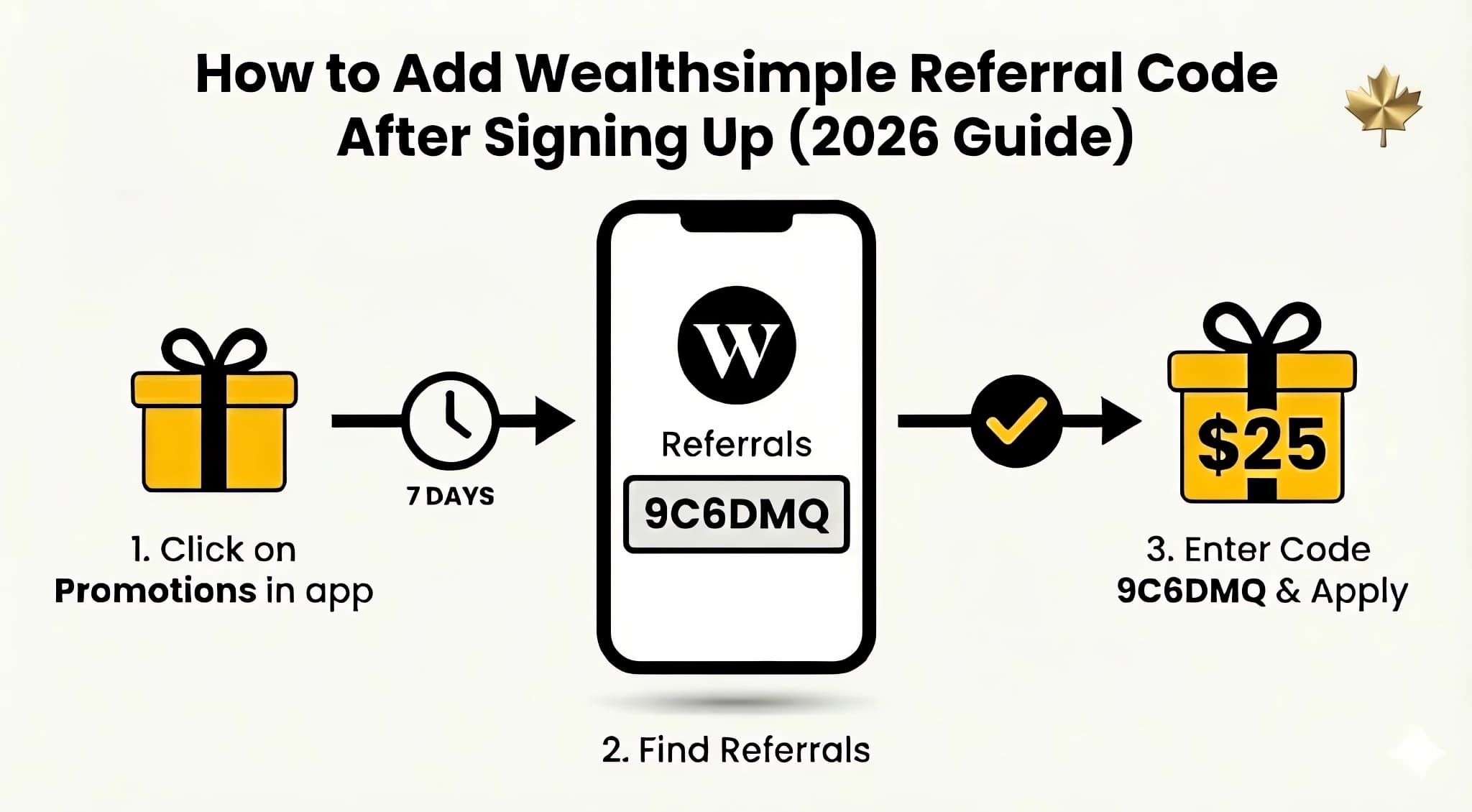

Getting Started with a Referral Bonus

Regardless of which tier you’ll eventually reach, everyone starts the same way, and everyone is eligible for the referral bonus.

Sign up with referral code 9C6DMQ and get a $25+ cash bonus.

If you’re transferring a large portfolio to immediately reach Premium or Generation, you may also benefit from the Referral Ladder Challenge where referrers can earn tiered bonuses based on their friend’s deposit amount.

Want to compare promotional benefits by tier? Learn when Wealthsimple promo codes might beat referral codes: Promo Code vs Referral Code Guide

Related Articles

- Wealthsimple Guide: Overview, Products & Referral Program

- Referral Ladder Challenge: Earn Up to $5,000

- Wealthsimple vs Questrade Fees 2025

- Wealthsimple Cash Account Review 2025

Frequently Asked Questions

Can I combine assets with my spouse to reach Generation status?

Yes, through the Wealthsimple Household feature.5 A Household is limited to 2 people who share the same residential address. Once linked, Wealthsimple combines your total assets to calculate your tier. For example, if you have $300,000 and your partner has $200,000, you will both be upgraded to Generation status and unlock the 2.25% interest rate and other perks.

Privacy note: Household members can only see the combined total—they cannot access each other’s individual account balances or activity.

If the market drops my balance below $100k, do I lose Premium status?

Wealthsimple generally protects you from market downturns. Your status is determined by net deposits OR total portfolio value, whichever is higher. If you deposit $100,000 and the market drops your value to $90,000, you typically maintain Premium status. You usually only risk downgrading if you withdraw funds that drop your net deposits below the threshold.

Do I have to pay the $10 USD fee for each account separately?

No. If you are a Core client paying for the USD account subscription ($10/month), that single fee covers all your eligible accounts (TFSA, RRSP, and Non-Registered). You do not need to pay per account. If you are Premium or Generation, this fee is waived entirely for all accounts.

Is my money locked in if I invest in Private Credit or Private Equity?

Yes, these assets have different liquidity rules than stocks. Unlike ETFs which can be sold instantly during market hours, Private Credit and Private Equity funds typically have specific monthly or quarterly redemption windows. In practice, the timeline is longer than it sounds — redemption requests often need to be submitted 30–60 days before the quarter ends, and the actual cash settlement can take another 30–90 days after that. You’re realistically looking at 4–6 months to access your capital.

Do Generation clients still get DragonPass lounge access?

Yes, but the structure changed in January 2026. Generation clients can access up to 10 lounge visits through two sources: 4 passes by selecting DragonPass as a Milestone Reward, and 6 passes through the Visa Airport Companion program. Note that the 4 Milestone passes must be manually selected as your reward choice, and the 6 companion passes require having the Visa Infinite Privilege card specifically.

Does TFSA + RRSP + Chequing all count toward tier status?

Yes. All Wealthsimple accounts are combined when calculating your tier.

Do referral bonuses count toward tier qualification?

The Wealthsimple sign up bonus itself is cash, not “deposits” for tier purposes. However, any funds you deposit to receive the bonus do count toward your tier status.

Sources

Footnotes

About the Author

Isabelle Reuben is a specialized finance writer focused on Canadian investment platforms and bonus optimization. With 5+ years tracking robo-advisors, she stress-tests Wealthsimple's features to transform fine print into actionable blueprints.