Wealthsimple Guide (2026): Products, Fees & Referral Program

A complete overview of the Wealthsimple ecosystem for 2026. We explain the products (Trade, Cash, Crypto), fees, and how the referral program works.

Wealthsimple is Canada’s largest online brokerage, offering commission-free trading, automated investing, crypto, and high-interest banking—all in one app. This guide explains how the platform works, what products are available, and how the referral bonus program operates.

Quick Navigation

- Promo vs Referral: Which is better? →

- Forgot your code? Add it after signup →

- Referral Ladder: Earn up to $5,000 →

- Platform overview (continue reading below)

Current Wealthsimple Referral Code (January 2026)

The current working Wealthsimple referral code is 9C6DMQ. When you use this code:

- You get: $25 cash bonus

- Minimum deposit: Just $1

- Bonus timing: Within 24 hours of your qualifying deposit

Searching for a Wealthsimple referral code with no deposit required? The $1 minimum is as close as it gets—essentially free money for pocket change.

Personal note: I opened my Wealthsimple account in late 2022 and it’s now my primary platform for everyday trading and my RRSP. The referral bonus was my first interaction with Wealthsimple—and years later, I’m still here.

How the Wealthsimple Referral Program Works

Honestly, Wealthsimple’s referral program is one of the better ones you’ll find in Canadian fintech—and I’ve tested quite a few of them over the years. It’s straightforward. The payout is genuinely quick. And the process? Dead simple. Here’s how the whole thing works:

Step 1: Sign Up Using a Referral Link

When you click a referral link (like the one above), you’re automatically connected to the referrer. No need to manually enter anything.

Step 2: Fund Your Account with $1+

You only need to deposit $1 or more within 30 days of opening your account.1 This can go into any eligible account:

- Self-directed Trading

- Managed Investing (Robo-advisor)

- Crypto

- Chequing account

Step 3: Receive Your $25 Bonus

Here’s the nice part—your cash bonus typically shows up in your Wealthsimple Chequing account within 24 hours. Most people get it the same day. Some within a few hours. Seriously. When I first signed up, my bonus landed in about three hours—I was honestly surprised at how fast it was.

The Referral Ladder: Referrers Can Earn Up to $5,000

Here’s something a lot of people miss—if you’re referring friends to Wealthsimple, the Referral Ladder Challenge lets you earn tiered bonuses based on how much your referred friend deposits. This promotion runs through December 31, 2025.

Here’s the full breakdown of what referrers earn:

| Friend’s Deposit Amount | Your Bonus (as Referrer) |

|---|---|

| $1 – $999 | $25 |

| $1,000 – $9,999 | $50 |

| $10,000 – $49,999 | $100 |

| $50,000 – $99,999 | $200 |

| $100,000 – $499,999 | $500 |

| $500,000 – $999,999 | $1,500 |

| $1,000,000+ | $5,000 |

Timing note: The base $25 bonus typically arrives within 24 hours. For additional ladder bonuses ($50+), it can take up to 14 business days after the end of the 30-day funding period.

If you already have a Wealthsimple account and refer someone who’s moving a decent-sized portfolio, this ladder can mean serious bonus cash.

👉 Learn more about the Referral Ladder Challenge

Transferring From a Big Bank? What You Need to Know

Many Canadians claiming the referral bonus are moving their investments from TD, RBC, BMO, Scotiabank, or CIBC. Here’s what to expect:

Transfer Fee Reimbursement

Most banks charge $135-$150 + tax to transfer out. Wealthsimple reimburses this fee if:

- You transfer $25,000 or more (increased from $15,000 as of April 10, 2025)2

- The transfer completes successfully

- You keep funds in Wealthsimple for 90 days

Note: If you saw Reddit posts or older articles mentioning a $15,000 minimum, that policy changed in April 2025. Transfers initiated on or after April 10, 2025 require a $25,000 minimum for fee reimbursement.

Bank-Specific Tips

TD Bank: Keep $160+ cash in your TD account to cover the transfer fee. TD won’t process the transfer if you don’t have enough cash to pay their fee.

BMO with Mutual Funds: BMO’s proprietary mutual funds can’t transfer “in-kind” to Wealthsimple. They’ll need to be sold first, which could create a tax event in non-registered accounts.

RBC/Scotiabank/CIBC: Generally straightforward. Expect 2-4 weeks for the full transfer process.

The 90-Day Extended Window

For institutional transfers (RRSP, TFSA, LIRA, etc.), Wealthsimple gives you a 90-day window instead of 30 days to complete the transfer and qualify for the referral ladder. This acknowledges the reality that bank transfers can be slow.

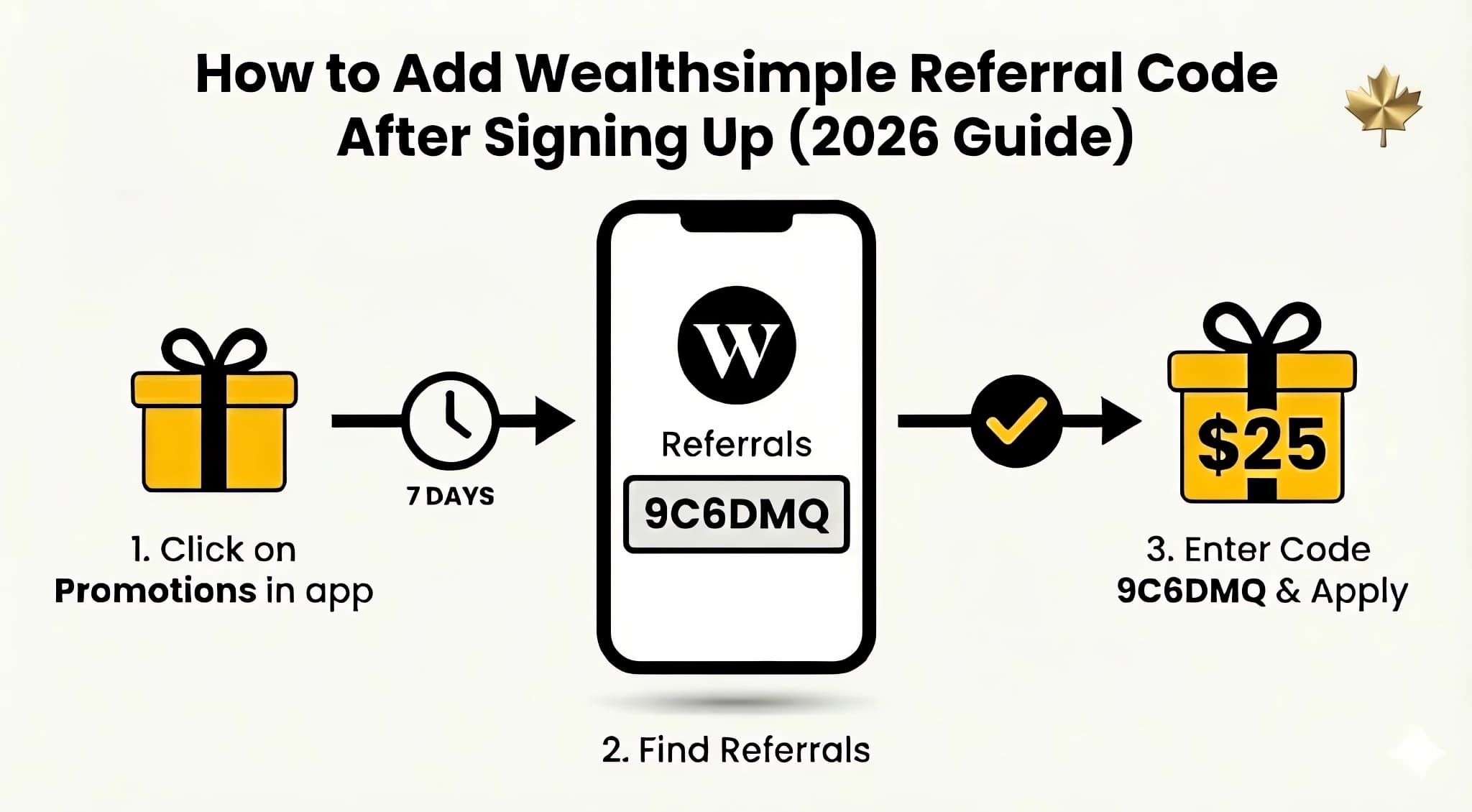

Wealthsimple Referral Code for Existing Clients

One of the most common questions we get is: “I already signed up but forgot to use a referral code. Is it too late?” If you’re an existing client looking for a Wealthsimple referral code, here’s the breakdown:

If You Haven’t Funded Your Account Yet

Good news! You can still add a referral code at any time before making your first deposit. Here’s how:

- Open the Wealthsimple app

- Tap the Gift icon at the top of the screen

- Go to the “Referrals” tab

- Select “I was referred by someone”

- Enter the code: 9C6DMQ

If You’ve Already Funded Your Account

You have a 7-day window after your first deposit to add a referral code retroactively.3 After 7 days, the option disappears from the app entirely.

To add the code during this window:

- Open the Wealthsimple app

- Navigate to Settings > Earn Rewards > Add a referral code

- Enter: 9C6DMQ

⚠️ Important: After 7 days, the system will reject any referral code attempts. This is a strict policy, and even customer support typically cannot override it.

👉 Full guide: How to Add a Referral Code After Signing Up

Referral Bonus Terms and Conditions

Alright, let’s talk fine print. Nobody loves this part. But it’s worth knowing before you jump in:

Eligibility Requirements

- Must be a new Wealthsimple client (never opened any account before)

- Must be a Canadian resident of legal age in your province

- Must fund your account with at least $1 within 30 days

Bonus Details

- Bonus is paid in cash, not stock or crypto

- Deposited to your Wealthsimple Chequing account

- Must be held for 180 days or it may be clawed back from withdrawals4

Tax Implications

- Wealthsimple does not issue tax slips for referral bonuses

- You may be responsible for reporting the income depending on your tax situation

👉 Full breakdown: Referral Bonus Terms & Conditions

What Is Wealthsimple? Quick Platform Overview

If you’re new to Wealthsimple, here’s what you’re signing up for:

Wealthsimple Trade (Self-Directed Investing)

- $0 commission on Canadian and US stocks5

- Trade stocks, ETFs, options, and crypto in one app

- Fractional shares available

- Extended hours trading

Wealthsimple Managed Investing (Robo-Advisor)

- Automated portfolio management

- Tax-loss harvesting

- Socially responsible and Halal portfolio options

- 0.4-0.5% management fee

Wealthsimple Cash (Banking)

- High-interest chequing account (0.75%-2.25%)

- Prepaid Mastercard with no FX fees

- CDIC coverage up to $1 million6

- ATM fee reimbursement (up to $5, Canada confirmed)

Wealthsimple Tax (Free Tax Filing)

- Pay-what-you-want pricing

- Auto-import from Wealthsimple accounts

- Cryptocurrency ACB calculation

The $25 sign up bonus applies to any of these account types—so if you’re only interested in banking or tax filing, you can still claim your bonus.

Why Canadians Are Switching to Wealthsimple

Understanding why others have made the switch can help you decide if it’s right for you. After two years of using the platform alongside other brokers and banks, here’s what I’ve found makes Wealthsimple stand out for the average Canadian investor:

The Fee Advantage

| What You’re Doing | Traditional Bank | Wealthsimple |

|---|---|---|

| Buy $5,000 of RBC stock | $9.95+ commission | $0 |

| Hold USD from dividends | Often poor exchange rates | Free USD account (Premium+) |

| Managed portfolio ($50K) | 1%+ fees | 0.4-0.5% |

| High-interest savings | 0.01-0.10% | 0.75%-2.25% |

For a typical investor making 2-3 trades per month with $50K invested, switching to Wealthsimple can save $300-500 annually—not including the referral bonus.

Mobile-First Experience

Wealthsimple consistently ranks as the top-rated financial app in Canada. The interface is designed for everyday investors, not traders who need Bloomberg terminals. Features include:

- Clean portfolio overview

- One-tap stock purchases

- Instant deposits from linked banks

- Real-time notifications for price movements

The All-in-One Ecosystem

What really sets Wealthsimple apart is the integration. Your investments, banking, crypto, and taxes all live in one place:

- Transfer between accounts instantly (no waiting for wire transfers)

- See your complete financial picture in one dashboard

- Tax time is simplified with automatic imports to Wealthsimple Tax

This integration is why starting with the referral bonus makes sense—even if you only use one feature now, you’ll have access to everything as your needs grow.

The Wealthsimple vs Questrade Question

If you’re comparing platforms, here’s the quick version:

| Feature | Wealthsimple | Questrade |

|---|---|---|

| Commission | $0 | $0 (as of 2025) |

| Currency conversion | 1.5% (or free with Premium) | 1.5% (or Norbert’s Gambit) |

| Mobile app | ⭐⭐⭐⭐⭐ | ⭐⭐⭐ |

| Sign up bonus | $25+ referral code | Varies |

| Banking integration | Full Cash account | None |

For most Canadians, especially those under $100K in assets, Wealthsimple offers the better overall experience. I’m still a Core client myself, and the 1.5% currency conversion fee on USD trades is the main limitation I notice—though Wealthsimple has announced Norbert’s Gambit support is coming in Q1 2026, which should eliminate this pain point for active US stock traders.

👉 Full comparison: Wealthsimple vs Questrade 2025

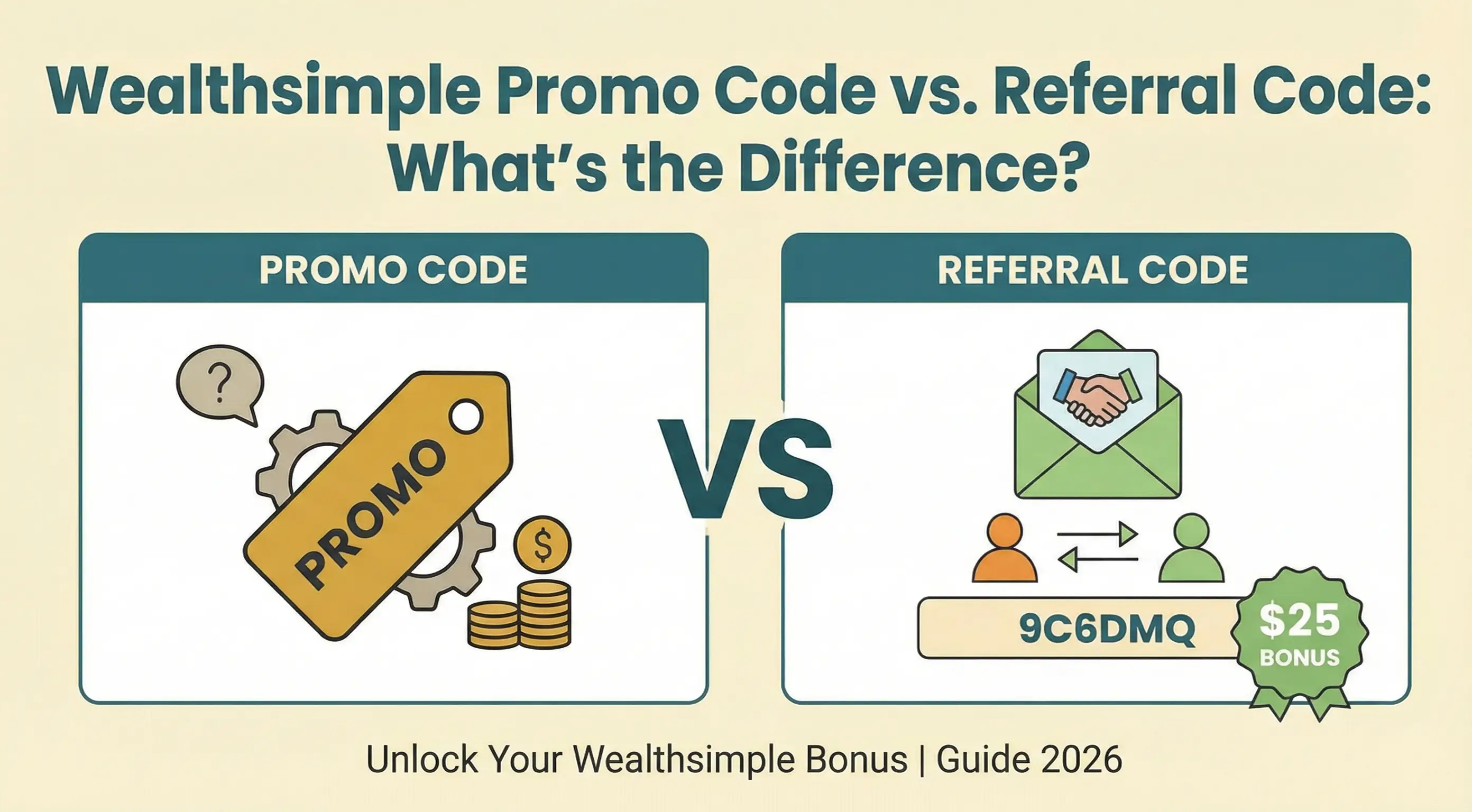

Wealthsimple Promo Code vs Referral Code: Which Is Better?

If you’ve been searching for a “Wealthsimple promo code” or “Wealthsimple sign up bonus,” you’ve probably noticed two types of codes floating around. Here’s the honest breakdown:

| Wealthsimple Promo Code | Referral Code | |

|---|---|---|

| Source | Seasonal campaigns | Existing users |

| Reward Type | Often devices (iPhone, AirPods) | Cash ($25+) |

| Funding Requirement | Usually $100K+ | Just $1 |

| Availability | Limited time | Always available |

| Stacking | Usually not stackable | Situationally stackable |

Why Most Canadians Should Use a Referral Code

From what we’ve seen here in Canada, the standard referral code is the better choice for everyday investors because:

- The $1 minimum is achievable by anyone looking for a Wealthsimple sign up bonus

- Cash is more flexible than the devices offered in promo campaigns

- It’s always available—no rushing to meet promotional deadlines

When a Wealthsimple Promo Code Makes Sense

That said, if you’re transferring $100,000+ and Wealthsimple is running one of their device promotions (like the iPhone or MacBook deals), the promo code might actually beat the referral bonus in terms of total value. We break down exactly when each option wins in our detailed comparison.

👉 See current Wealthsimple promo codes and compare your options

Referral Code vs Promo Code: Real Considerations

When deciding between a referral code and a promo code, here’s what actually matters:

Referral Code ($25 Cash)

- Bonus: $25 cash (same regardless of deposit amount)

- Hold period: 180 days

- Minimum deposit: Just $1

- Best for: Anyone who wants quick, guaranteed value with low commitment

Promo Code (Device Offers)

- Bonus: Devices like iPhone, MacBook, AirPods

- Hold period: Often 12+ months with strict requirements

- Minimum deposit: Usually $100,000+

- Best for: Large transfers where you’d buy the device anyway

The Real ROI Question

The $25 referral bonus is straightforward—but device promos require you to lock up significant capital for a year or more. Unless you’re also investing that money in market assets (stocks, ETFs, RRSPs), the actual return on that locked capital can be underwhelming compared to alternatives.

Bottom line: For most people, the referral code’s instant $25 with a shorter hold period and no large deposit requirement is the smarter choice.

Why Use Our Referral Code?

Look, there are referral codes all over Reddit and random forums. Here’s why ours is worth using:

- ✅ We actually test it — checked regularly to make sure it’s still working

- ✅ Kept up to date — if something changes, we’ll know about it

- ✅ Complete guides — not just a code dump, but actual helpful info

- ✅ No spam — just this resource, that’s it

Ready to Claim Your $25?

Seriously, the whole process takes maybe 5 minutes. That’s it. Five minutes for free money.

- Get the referral code on the homepage →

- Complete the quick identity verification

- Link your bank account

- Deposit $1 or more

- Get your $25 cash bonus within 24 hours

If you’re transferring a larger portfolio, remember you could earn up to $5,000 through the referral ladder program.

Beyond the Sign Up Bonus: Ongoing Value

The referral bonus is just the beginning. Here’s how Wealthsimple continues to provide value:

Tier Benefits

| Tier | Threshold | Key Benefits |

|---|---|---|

| Core | $0+ | $0 commissions, 0.75%-1.25% cash interest7 |

| Premium | $100K+ | Free USD account, 1.75% cash interest, lower fees |

| Generation | $500K+ | Lowest fees, private investments, lifestyle perks |

The Referrer Program

Once you’re a Wealthsimple client, you can share your own referral code:

- Earn $25 for each friend who signs up

- No cap on referrals

- Your friends get the same $25 bonus

Some active referrers on Reddit report earning thousands through this program over time.

Seasonal Promotions

Wealthsimple regularly runs promotions throughout the year:

- RRSP Season (Jan-Feb): Transfer bonuses and deadline reminders

- Tax Season (Mar-Apr): Wealthsimple Tax integration promos

- Holiday Season (Nov-Dec): Device giveaways for high-value transfers

Staying with Wealthsimple means you’ll be eligible for future offers—another reason to claim your initial sign up bonus and get started.

Related Articles

- How to Add a Referral Code After Signing Up

- Referral Ladder Challenge: Earn Up to $5,000

- Referral Bonus Terms & Conditions Explained

- Promo Code vs Referral Code: What’s the Difference?

- Wealthsimple Core vs Premium vs Generation

Frequently Asked Questions

When will I receive my Wealthsimple sign up bonus?

Your $25 cash bonus is typically deposited within 24 hours of making a qualifying deposit of $1 or more. From what we’ve seen, most users get it the same day.

Can I use a referral code if I already have a Wealthsimple account?

Only if you’ve never funded any account before. If you’ve already made a deposit, you have exactly 7 days to add a referral code retroactively.

I’ve used Wealthsimple Tax before. Am I eligible for the sign up bonus?

Yes, in most cases. Wealthsimple’s terms define a “New Client” as someone who has not previously opened a Wealthsimple Investing, Crypto, or Chequing account. If you have only ever used Wealthsimple Tax (formerly SimpleTax) to file your return, you are likely still eligible for the $25 bonus when you open and fund your first asset account.

Can I use a referral code to open a Corporate Account?

Yes, Corporate Accounts are eligible for referral bonuses. However, because Wealthsimple Corporate accounts do not always have “Chequing” features enabled, the referral bonus is typically deposited into the personal non-registered account of the authorized trader associated with the corporation.

Can I refer my spouse if we live at the same address?

Yes. You can refer friends, family, and spouses even if they live in the same household. As long as the person you are referring is a new client (has never funded a Wealthsimple account), you will both receive the cash bonus.

Where does my referral bonus go?

Bonuses are deposited into your Wealthsimple Chequing account, not your investment accounts. This prevents any impact on your TFSA or RRSP contribution room.

Can I stack a Wealthsimple promo code with a referral code?

Generally, no. You have to choose one or the other when signing up. The same funds can’t trigger both bonuses.

Can I refer my friends after signing up?

Yes! Once you’re a Wealthsimple client, you get your own referral link and can earn $25 for each friend who signs up and deposits $1+. There’s no limit to how many people you can refer.

Footnotes

Wealthsimple - How to Use a Referral Code: https://promotions.wealthsimple.com/hc/en-ca/articles/19646567019035-Wealthsimple-Referral-Bonus-Promotion ↩

Wealthsimple - Transfer Fee Reimbursement: https://promotions.wealthsimple.com/hc/en-ca/articles/19646567019035-Wealthsimple-Referral-Bonus-Promotion ↩

Wealthsimple - How to Use a Referral Code: https://promotions.wealthsimple.com/hc/en-ca/articles/19646567019035-Wealthsimple-Referral-Bonus-Promotion ↩

Wealthsimple - Referral Program: https://promotions.wealthsimple.com/hc/en-ca/articles/19646567019035-Wealthsimple-Referral-Bonus-Promotion ↩

Wealthsimple - Pricing: https://www.wealthsimple.com/en-ca/pricing ↩

CDIC - Your Coverage: https://www.cdic.ca/your-coverage/ ↩

Wealthsimple - Wealthsimple Cash: https://www.wealthsimple.com/en-ca/product/cash ↩

- wealthsimple referral code

- wealthsimple bonus

- wealthsimple sign up bonus

- wealthsimple promo code

- wealthsimple referral 2026

About the Author

Isabelle Reuben is a specialized finance writer focused on Canadian investment platforms and bonus optimization. With 5+ years tracking robo-advisors, she stress-tests Wealthsimple's features to transform fine print into actionable blueprints.